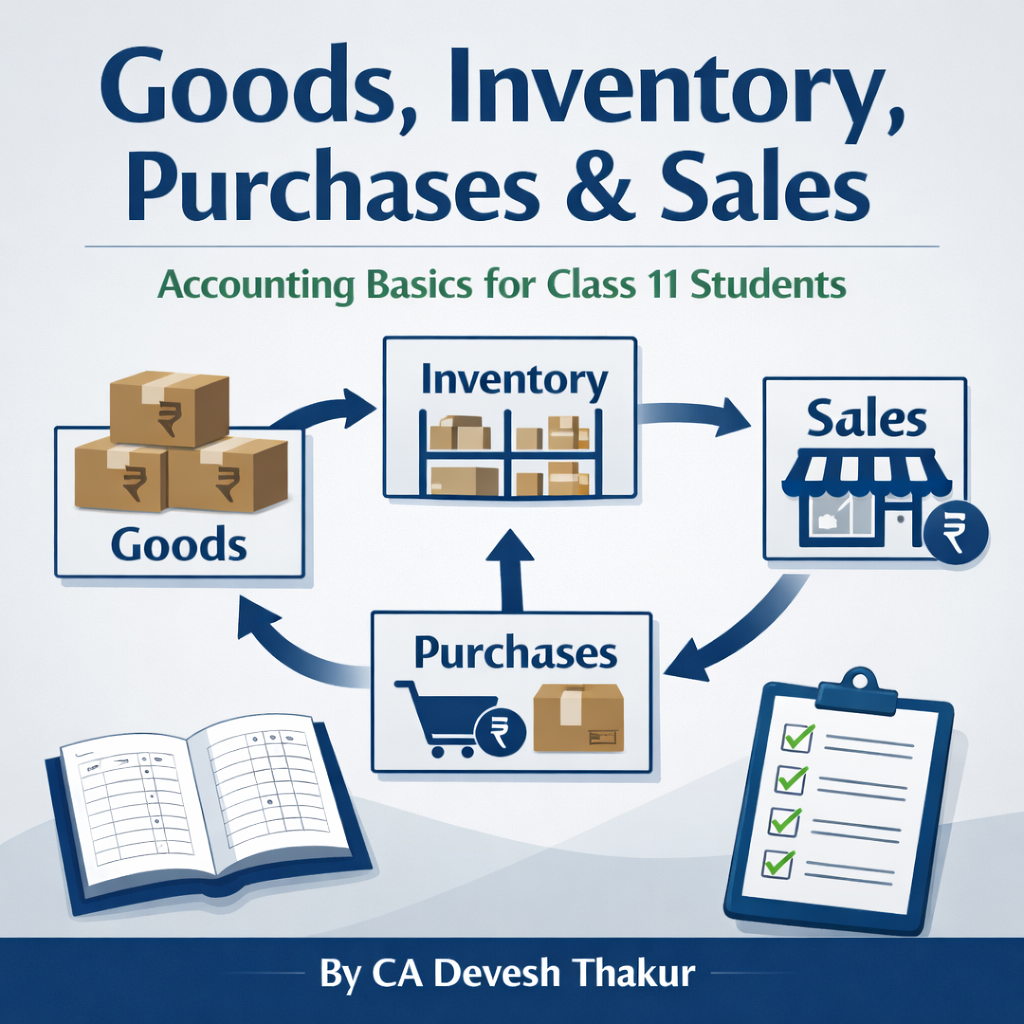

Introduction – Day 22 of 50 days accounting challenge

Class 11 Accountancy ka foundation Goods, Stock, Purchases aur Sales jaise basic concepts par hi banta hai.

Agar ye concepts clear ho gaye, toh journal entries, trading account aur final accounts sab easy lagne lagenge.

Is blog mein hum har concept ko:

- Simple Hindi–English mix

- Daily life examples

- Exam point of view

mein detail mein samjhenge.

1. GOODS (माल / वस्तुएँ)

Meaning of Goods

Goods means those items which a business buys or produces for the purpose of selling.

👉 Simple words mein:

Jo cheez business bechne ke liye rakhta hai, wahi goods hoti hai.

Important Point

Goods ka purpose hamesha sale hota hai, use nahi.

Examples

- Mobile shop ke liye mobiles

- Garments shop ke liye shirts

- Furniture dealer ke liye tables

Goods vs Assets (Very Important)

- Office furniture → Asset

- Furniture bought for resale → Goods

📌 Exam Tip

Question mein agar likha ho “for business use”, toh asset.

Agar likha ho “for resale”, toh goods.

2. STOCK (Inventory)

Meaning of Stock

Stock means goods which are lying unsold with the business at any particular date.

👉 Simple words:

Business ke paas jo maal bacha hua hota hai, use stock kehte hain.

Stock ko teen categories mein divide kiya jata hai:

(A) RAW MATERIAL (कच्चा माल)

Meaning

Raw material is the basic material used to manufacture goods.

👉 Simple words:

Jo cheez product banane ke kaam aati hai, par khud sell nahi hoti, wahi raw material hai.

Examples

- Wood for furniture

- Cotton for garments

- Steel for utensils

(B) WORK IN PROGRESS (WIP) – अधूरा माल

Meaning

Work in Progress means goods which are partially completed but not fully finished.

👉 Simple words:

Maal jo ban raha hai par abhi complete nahi hua, woh WIP hota hai.

Examples

- Half-stitched clothes

- Furniture jisme polishing baaki ho

- Cake jo oven mein hai

📌 Exam Tip

Words like “partly completed”, “under process” = WIP

(C) FINISHED GOODS (तैयार माल)

Meaning

Finished goods are goods which are completely manufactured and ready for sale.

👉 Simple words:

Jo maal 100% ready hai bechne ke liye, use finished goods kehte hain.

Examples

- Ready garments

- Packed biscuits

- Fully finished table

3. PURCHASES (खरीद)

Meaning of Purchases

Purchases means buying of goods for resale or for manufacturing purposes.

👉 Simple words:

Business jab maal bechne ke liye kharidta hai, use purchases kehte hain.

Types of Purchases

- Cash Purchases – turant payment

- Credit Purchases – baad mein payment

📌 Purchases sirf goods ki hoti hai, assets ki nahi.

Trade Discount (व्यापार छूट)

Meaning

Trade discount is the discount allowed by seller on list price to encourage bulk buying.

Important Accounting Rule

👉 Trade Discount is not recorded separately in books

Example

List Price = ₹20,000

Trade Discount = 10%

Trade Discount = ₹2,000

Net Purchase Value = ₹18,000

📌 Books mein purchase ₹18,000 record hogi, ₹20,000 nahi.

PURCHASE JOURNAL

Meaning

Purchase Journal is used to record credit purchases of goods only.

👉 Simple words:

Jab business udhaar par maal kharidta hai, toh entry Purchase Journal mein hoti hai.

What is NOT recorded?

- Cash purchases ❌

- Purchase of assets ❌

Example

Purchased goods from Ram Traders on credit ₹18,000.

4. SALES (बिक्री)

Meaning of Sales

Sales means selling of goods by the business to customers.

👉 Simple words:

Business jab apna maal customers ko bechta hai, use sales kehte hain.

Types of Sales

- Cash Sales – payment immediately

- Credit Sales – payment later

📌 Sales sirf goods ki hoti hai, asset sale nahi.

SALES JOURNAL

Meaning

Sales Journal is used to record credit sales of goods.

👉 Simple words:

Jab business udhaar par maal bechta hai, entry Sales Journal mein hoti hai.

What is NOT recorded?

- Cash sales ❌

- Sale of old assets ❌

Example

Sold goods to Mohan on credit ₹25,000.

5. COMMON EXAM CONFUSIONS (Clear Them Once)

Purchases vs Stock

- Purchases → Year ke andar kharida hua maal

- Stock → Year end pe bacha hua maal

Goods vs Asset

- Goods → Sell karne ke liye

- Asset → Business chalane ke liye

Conclusion

Agar aap:

- Goods ka meaning

- Stock ke types

- Purchases aur Sales ka difference

- Trade discount ka rule

- Purchase aur Sales Journal ka use

ye sab clear rakhte ho, toh Class 11 Accountancy ka base strong ho jata hai.

👉 Ye concepts Class 12, CA Foundation, CUET aur competitive exams mein bhi kaam aate hain.