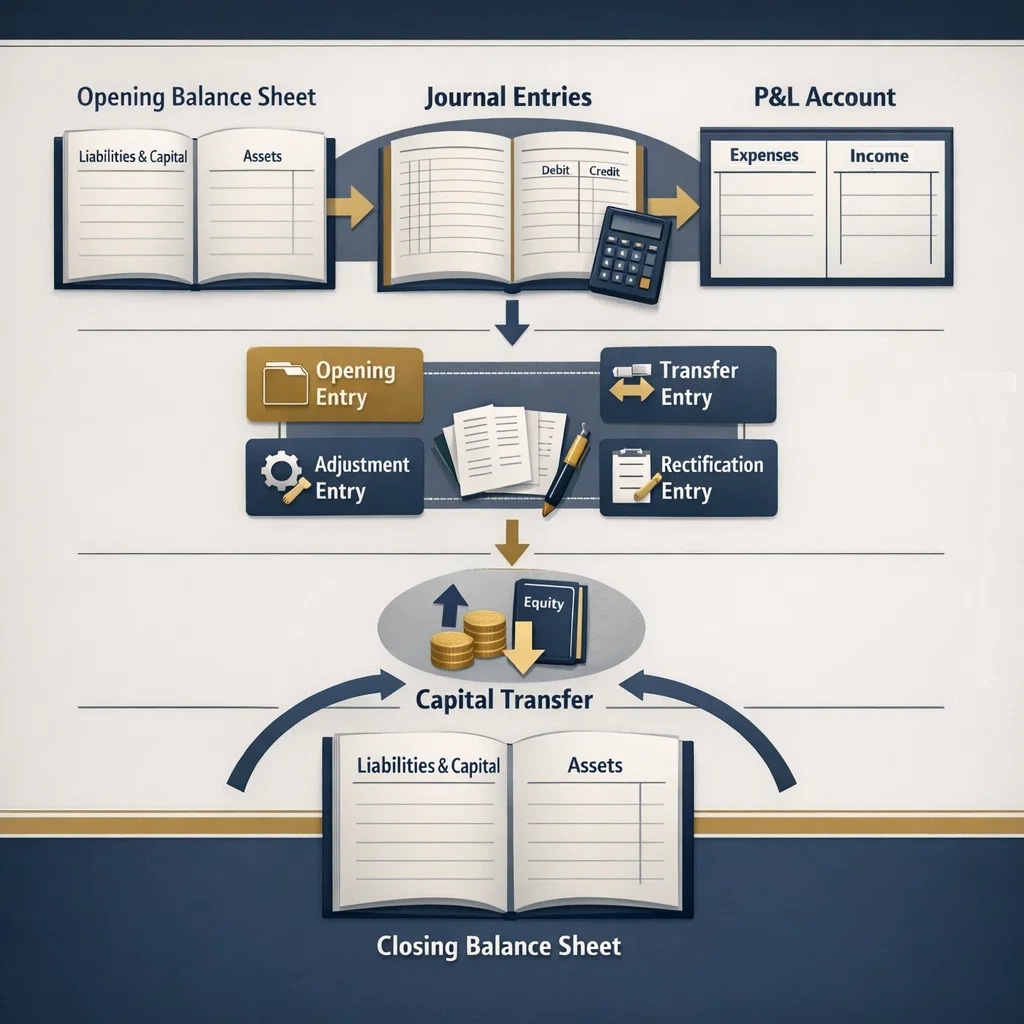

Day 25 – 50 Days Accounting Challenge | Accounting Made Easy for Class 11

Accounting students ka sabse common doubt hota hai:

👉 “Entry kaunsi pass karni hai, kab aur kyun?”

Isliye Day 25 me hum real figures + real flow ke saath samjhenge:

- Last Year Balance Sheet (31-03-2025)

- Current Year Profit & Loss Account

- Current Year Balance Sheet (31-03-2026)

- Types of Entries:

- Opening Entry

- Closing Entry

- Transfer Entry

- Adjustment Entry

- Rectification Entry

Sab kuch inter-linked hoga, taaki aapko accounting ratna nahi, balki samajhna aaye.

1️⃣ Last Year Balance Sheet (As on 31-03-2025)

📘 Balance Sheet – Previous Year

Liabilities

| Particulars | Amount (₹) |

| Capital | 5,00,000 |

| Long-Term Loan | 2,00,000 |

| Creditors | 1,20,000 |

| Outstanding Expenses | 30,000 |

| Total | 8,50,000 |

Assets

| Particulars | Amount (₹) |

| Land & Building | 3,50,000 |

| Machinery | 2,00,000 |

| Furniture | 80,000 |

| Closing Stock | 1,10,000 |

| Debtors | 70,000 |

| Cash | 40,000 |

| Total | 8,50,000 |

👉 Ye Balance Sheet naye saal ka base banti hai.

2️⃣ Opening Entry (01-04-2025)

🔹 Concept (Hinglish)

New accounting year ke start me, previous year ke assets aur liabilities ko books me lana hi Opening Entry kehlata hai.

👉 Capital balancing figure hota hai.

✍ Opening Journal Entry

Land & Building A/c Dr. 3,50,000

Machinery A/c Dr. 2,00,000

Furniture A/c Dr. 80,000

Stock A/c Dr. 1,10,000

Debtors A/c Dr. 70,000

Cash A/c Dr. 40,000

To Creditors A/c 1,20,000

To Outstanding Exp. A/c 30,000

To Long-Term Loan A/c 2,00,000

To Capital A/c 5,00,000

👉 Opening Entry sirf ek baar pass hoti hai – saal ke first day.

3️⃣ Profit & Loss Account (Year Ended 31-03-2026)

📈 Income Side

| Particulars | Amount (₹) |

| Gross Profit | 3,20,000 |

| Commission Received | 40,000 |

| Interest Received | 20,000 |

| Total Income | 3,80,000 |

📉 Expense Side

| Particulars | Amount (₹) |

| Salary | 1,20,000 |

| Rent | 60,000 |

| Electricity | 25,000 |

| Depreciation | 45,000 |

| Interest on Loan | 30,000 |

| Miscellaneous Expenses | 20,000 |

| Total Expenses | 3,00,000 |

✅ Net Profit

Net Profit = ₹80,000

4️⃣ Closing Entries

🔹 Concept (Hinglish)

Accounting year ke end par saare income aur expense accounts close karne padte hain — is process ko Closing Entries kehte hain.

✍ Closing Entry – Income

Income A/c Dr. 3,80,000

To P&L A/c 3,80,000

✍ Closing Entry – Expenses

P&L A/c Dr. 3,00,000

To Expenses A/c 3,00,000

👉 Iske baad P&L ka balance = Net Profit.

5️⃣ Transfer Entry (Profit to Capital)

🔹 Concept (Hinglish)

Profit business kamata hai, par owner ka haq hota hai.

Isliye profit Capital A/c me transfer hota hai.

✍ Transfer Entry

P&L A/c Dr. 80,000

To Capital A/c 80,000

6️⃣ Adjustment Entry (Matching Concept)

🔹 Example

Salary ₹10,000 outstanding hai.

✍ Adjustment Entry

Salary A/c Dr. 10,000

To Outstanding Salary A/c 10,000

👉 Expense bhi increase, liability bhi increase.

7️⃣ Rectification Entry (Error Correction)

🔹 Mistake

Furniture ₹15,000 ko Expense me debit kar diya gaya.

✍ Rectification Entry

Furniture A/c Dr. 15,000

To Misc Expense A/c 15,000

👉 Galat jagah se nikaal kar sahi jagah dalna = Rectification Entry

8️⃣ Current Year Balance Sheet (As on 31-03-2026)

📘 Balance Sheet – New Year

Liabilities

| Particulars | Amount (₹) |

| Capital (5,00,000 + 80,000) | 5,80,000 |

| Long-Term Loan | 2,00,000 |

| Creditors | 1,40,000 |

| Outstanding Expenses | 40,000 |

| Total | 9,60,000 |

Assets

| Particulars | Amount (₹) |

| Land & Building | 3,50,000 |

| Machinery | 1,80,000 |

| Furniture | 95,000 |

| Closing Stock | 1,30,000 |

| Debtors | 90,000 |

| Cash | 1,15,000 |

| Total | 9,60,000 |

9️⃣ One-Look Revision Table

| Entry Type | Kab Pass Hoti Hai |

| Opening Entry | New year start |

| Closing Entry | Year end |

| Transfer Entry | Profit/Loss transfer |

| Adjustment Entry | Accrual matching |

| Rectification Entry | Mistake correction |

🎯 Final Student Insight (Day 25)

Balance Sheet → Opening Entry → Transactions → P&L → Closing → Transfer → New Balance Sheet

Agar ye flow clear ho gaya, to accounting fear khatam.