Classification of Accounts – Modern Approach (Day 10 of 50 Days Accounting Challenge)

Accounting ko samajhne ka sabse strong foundation hota hai –

👉 Classification of Accounts

👉 Debit aur Credit ka logical reason

Agar yeh clear ho gaya, to journal entries, ledger, trial balance sab easy ho jaata hai.

Is blog mein hum Modern Approach of Accounting ko simple Hinglish mein samjhenge –

✔ Logic ke saath

✔ Practical illustration ke saath

✔ December 2025 ke real-life journal entries ke saath

Golden Trick to Remember Classification of Accounts

“ALL LIONS CAN ROAR EASILY”

| Letter | Meaning |

| A | Asset |

| L | Liability |

| C | Capital |

| R | Revenue |

| E | Expense |

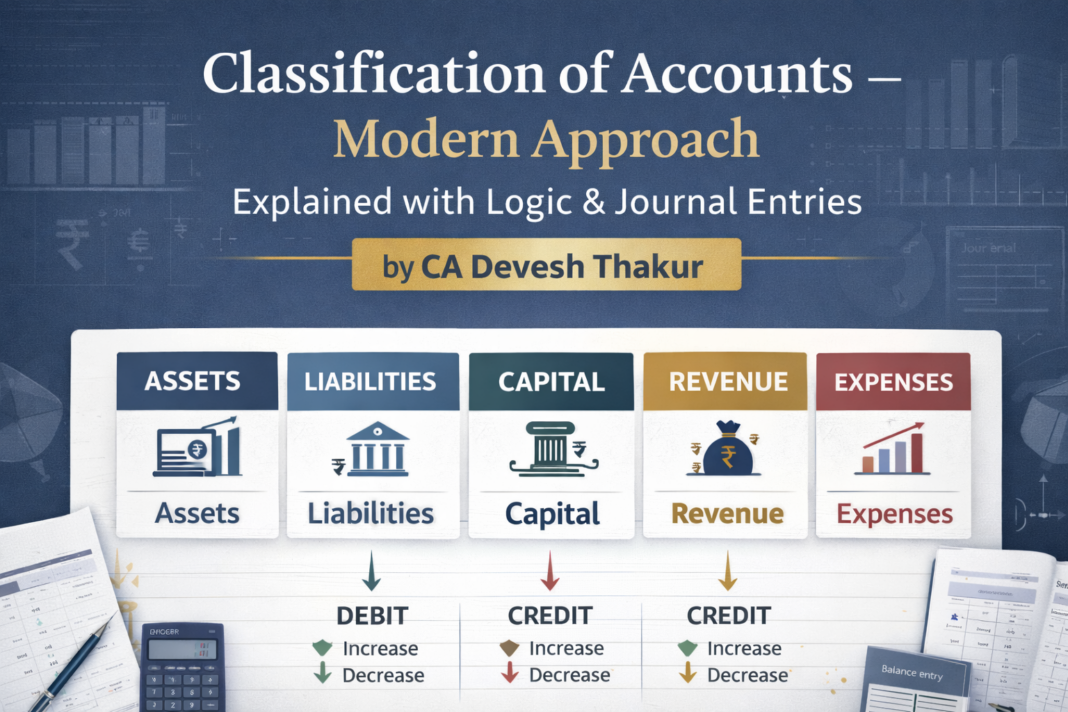

👉 Modern accounting mein sirf 5 types ke accounts hote hain.

Modern Approach of Accounting – Core Concept

Modern approach ka base simple hai:

“Increase ya Decrease ko dekho, account ka nature samjho.”

Debit & Credit Rules – Modern Approach

| Account Type | Debit | Credit |

| Assets | Increase | Decrease |

| Expenses | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Capital | Decrease | Increase |

| Revenue / Income | Decrease | Increase |

👉 Yaad rakho:

Assets & Expenses → Debit side strong

Liabilities, Capital & Revenue → Credit side strong

Why Any Account is Debited or Credited? (Logical Reasoning)

1️⃣ Asset Account

Asset matlab jo business ke paas hai.

- Asset badhta hai → Debit

- Asset ghatta hai → Credit

📌 Example: Cash, Furniture, Bank, Machinery

2️⃣ Expense Account

Expense ka matlab business ka kharcha.

- Expense badhta hai → Debit

- Expense ghatta hai → Credit

📌 Example: Salary, Rent, Electricity

3️⃣ Liability Account

Liability matlab business ki zimmedari / obligation.

- Liability badhti hai → Credit

- Liability ghat-ti hai → Debit

📌 Example: Loan, Creditors

4️⃣ Capital Account

Capital owner ka business mein interest.

- Capital increase → Credit

- Capital decrease → Debit

📌 Owner invested more money → Capital ↑ → Credit

5️⃣ Revenue / Income Account

Revenue matlab business ki kamai.

- Income badhti hai → Credit

- Income ghat-ti hai → Debit

📌 Example: Sales, Commission Income

Profit & Loss Account vs Balance Sheet (Conceptual Clarity)

Profit & Loss Account

👉 Performance dikhata hai

- Expenses (Debit side)

- Income (Credit side)

Balance Sheet

👉 Financial position dikhata hai

- Assets (Debit balance)

- Liabilities & Capital (Credit balance)

Detailed Illustration with Journal Entries (December 2025)

Transaction 1: Owner Started Business with Cash

Date: 01-12-2025

Owner invested ₹1,00,000 cash.

| Account | Debit (₹) | Credit (₹) |

| Cash A/c | 1,00,000 | |

| Capital A/c | 1,00,000 |

🧠 Logic:

Cash (Asset) ↑ → Debit

Capital ↑ → Credit

Transaction 2: Purchased Furniture for Cash

Date: 05-12-2025

Furniture purchased worth ₹20,000.

| Account | Debit (₹) | Credit (₹) |

| Furniture A/c | 20,000 | |

| Cash A/c | 20,000 |

🧠 Logic:

Furniture (Asset) ↑ → Debit

Cash (Asset) ↓ → Credit

Transaction 3: Loan Taken from Bank

Date: 10-12-2025

Loan taken ₹50,000.

| Account | Debit (₹) | Credit (₹) |

| Bank / Cash A/c | 50,000 | |

| Bank Loan A/c | 50,000 |

🧠 Logic:

Cash ↑ → Debit

Loan (Liability) ↑ → Credit

Transaction 4: Goods Sold for Cash

Date: 15-12-2025

Goods sold for ₹30,000.

| Account | Debit (₹) | Credit (₹) |

| Cash A/c | 30,000 | |

| Sales A/c | 30,000 |

🧠 Logic:

Cash ↑ → Debit

Sales (Revenue) ↑ → Credit

Transaction 5: Salary Paid

Date: 20-12-2025

Salary paid ₹5,000.

| Account | Debit (₹) | Credit (₹) |

| Salary A/c | 5,000 | |

| Cash A/c | 5,000 |

🧠 Logic:

Salary (Expense) ↑ → Debit

Cash ↓ → Credit

Most Important Exam & Practical Tip

👉 Debit / Credit ratta nahi maarna

👉 Sirf yeh socho:

- Account ka type kya hai?

- Increase ho raha hai ya decrease?

Agar yeh 2 questions ka answer mil gaya, journal entry automatic ban jaayegi.

Conclusion

Modern approach accounting ko logical, practical aur real-life oriented bana deta hai.

Is approach se:

- Journal entries easy ho jaati hain

- GST, Income Tax & Practical accounting strong hoti hai

- Confusion permanently khatam ho jaata hai