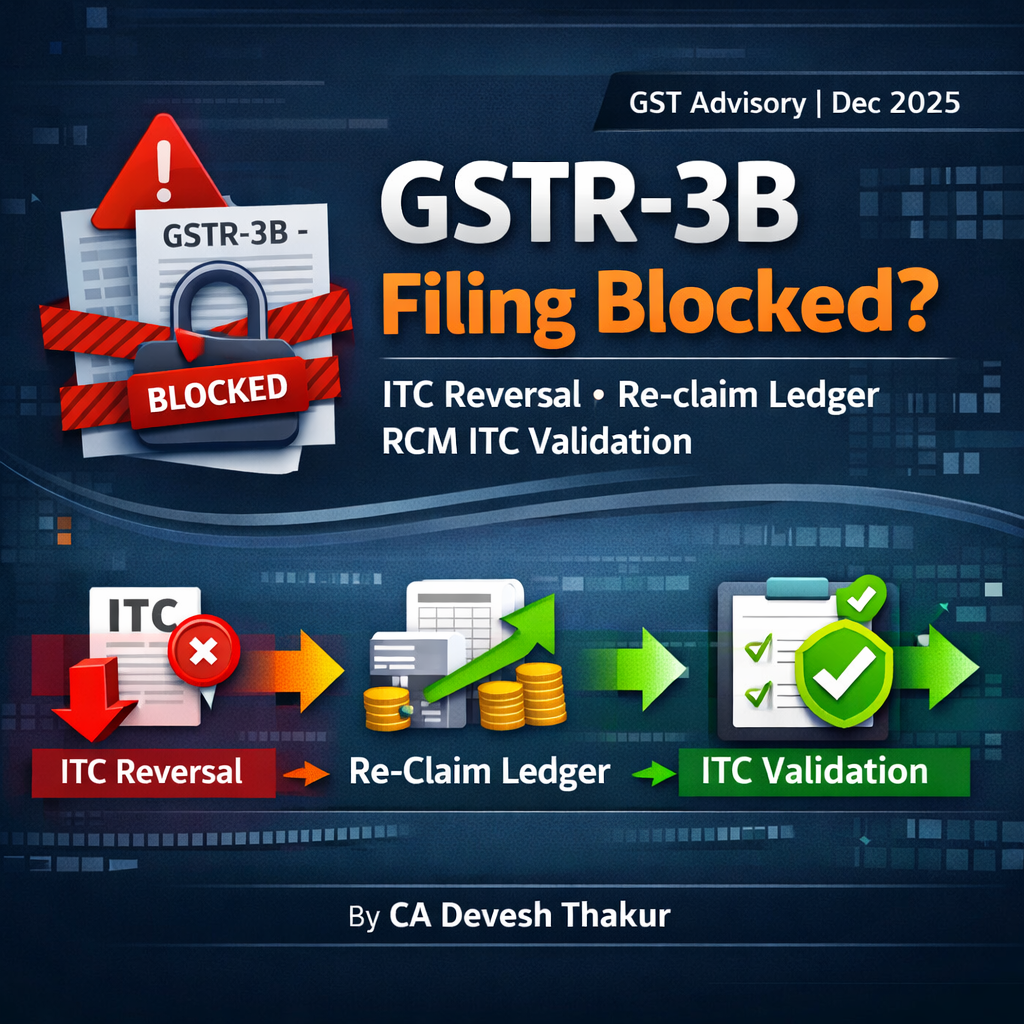

Advisory & FAQ on Electronic Credit Reversal and Re-claimed Statement and RCM Liability/ITC Statement – Complete Practical Guide

Introduction: Why This Advisory Changes Everything

If you are still treating ITC reversal, re-claim and RCM ITC as mere reporting entries, you are already exposed. GSTN has moved decisively from post-facto warnings to system-driven enforcement. The advisory dated 29 December 2025, read with the earlier RCM Statement introduction (23 August 2024), marks a structural shift in how ITC is regulated in GSTR-3B.

This blog is not a summary. It is a conceptual + operational deep dive explaining:

- Why these two new statements were introduced

- How they technically work inside GSTR-3B

- What validations will block your return filing

- How to correct negative balances

- What professionals and businesses must do before the system stops them

If you ignore this, GSTR-3B filing will simply not move forward.

Background: The Core Problem GSTN Is Fixing

For years, GST compliance suffered from three chronic issues:

- ITC reversed but never tracked – especially reversals under Rule 37, 42, 43, or provisional reversals

- Premature or excess ITC re-claims without linkage to original reversals

- RCM ITC mismatch – ITC claimed without actual payment of RCM liability

GSTR-3B allowed all of this because it was self-declaratory.

GSTN has now said: Enough.

The solution is ledger-based discipline.

Part A: Electronic Credit Reversal and Re-claimed Statement (ITC Reclaim Ledger)

1. What Is the Electronic Credit Reversal and Re-claimed Statement?

This is a system-generated statement that tracks ITC reversed and re-claimed period-wise.

It captures:

- ITC reversed in Table 4(B)(2) of GSTR-3B

- ITC re-claimed through:

- Table 4(A)(5)

- Table 4(D)(1)

The ledger ensures that:

You can only re-claim ITC that was actually reversed earlier.

No assumptions. No memory-based accounting. Only ledger-backed re-claims.

2. Applicability Timeline

| Taxpayer Type | Applicable From |

| Monthly filers | August 2023 return |

| Quarterly filers | July–September 2023 quarter |

3. Opening Balance Facility – Why It Was Given

GSTN knew one thing: historical reversals existed outside the system.

So taxpayers were given multiple chances to declare:

ITC reversed earlier but not yet re-claimed

as Opening Balance in the Reclaim Ledger.

This was not a favor. It was a last reconciliation window.

4. How to View the Reclaim Ledger

Navigation:

Dashboard → Services → Ledger → Electronic Credit Reversal and Re-claimed Statement

Here you will see:

- Opening balance

- ITC reversed (period-wise)

- ITC re-claimed

- Closing balance

5. Current System Behavior (Till Now)

As of now:

- If you try to re-claim excess ITC → Warning message appears

- But filing of GSTR-3B is still allowed

This leniency is about to end.

6. Upcoming Hard Validation (Critical)

Very shortly:

GSTR-3B filing will be blocked if:

ITC re-claimed in Table 4(D)(1) >

- Closing balance of Reclaim Ledger +

- ITC reversed in Table 4(B)(2) of the current period

This is not advisory-level guidance. This is system logic.

7. Negative Closing Balance – What It Means

If your Reclaim Ledger shows a negative balance, it means only one thing:

You have already re-claimed ITC more than what you ever reversed.

There is no alternate interpretation.

8. How to Fix Negative Reclaim Ledger Balance

GSTN will not allow GSTR-3B filing until correction is made.

Mandatory Action:

- Reverse the excess ITC in Table 4(B)(2) of current GSTR-3B

If current-period ITC is insufficient:

- The reversal amount will be added to output tax liability

Example:

- Ledger closing balance: –₹10,000

- Action required: Reverse ₹10,000 in Table 4(B)(2)

No workaround exists.

Part B: RCM Liability / ITC Statement (RCM Ledger)

1. Why a Separate RCM Ledger Was Introduced

RCM compliance was being abused through timing gaps:

- ITC claimed first

- RCM liability paid later (or never)

GSTN closed this loophole with a dedicated RCM tracking statement.

2. What the RCM Liability/ITC Statement Tracks

This statement captures:

- RCM liability declared in Table 3.1(d)

- Corresponding ITC claimed in:

- Table 4(A)(2) – RCM on goods/services

- Table 4(A)(3) – RCM on imports

It works return-period-wise.

3. Applicability Timeline

| Taxpayer Type | Applicable From |

| Monthly filers | August 2024 |

| Quarterly filers | July–September 2024 |

4. Viewing the RCM Ledger

Navigation:

Services → Ledger → RCM Liability/ITC Statement

5. Opening Balance in RCM Ledger – Extremely Important

Taxpayers were allowed to report opening balance till:

- 31 October 2024

- Amendments allowed till 30 November 2024 (3 attempts)

After this, the system freezes historical corrections.

6. How to Decide Opening Balance Value

Case 1: Excess RCM Liability Paid Earlier

- Liability paid in Table 3.1(d)

- ITC not claimed

→ Declare Positive Opening Balance

Case 2: Excess RCM ITC Claimed Earlier

- ITC claimed in Table 4(A)(2)/(3)

- Liability not paid

→ Declare Negative Opening Balance

7. Critical Rule: RCM ITC Re-claiming

RCM ITC reversed earlier cannot be re-claimed via Table 4(A)(2) or 4(A)(3).

It must be re-claimed only through:

- Table 4(A)(5) (if eligible)

This is where most professionals still go wrong.

8. Upcoming Validation for RCM ITC

GSTR-3B filing will be blocked if:

RCM ITC claimed in Table 4(A)(2)/(3) >

- RCM liability paid in Table 3.1(d) of same period +

- Closing balance of RCM Ledger

This enforces pay first, claim later.

9. Negative Closing Balance in RCM Ledger

Negative balance = excess ITC already claimed.

To proceed, taxpayer must choose one:

- Pay additional RCM liability in Table 3.1(d)

- Reduce ITC claimed in Table 4(A)(2)/(3)

No third option exists.

10. Practical Example

- RCM Ledger closing balance: –₹5,000

Options:

- Pay ₹5,000 additional RCM tax

OR - Reduce RCM ITC by ₹5,000 in current return

Only after correction → GSTR-3B allowed.

Compliance Strategy: What Professionals Must Do Now

If you are advising clients or managing multiple GSTINs, stop reacting and start controlling.

Immediate Action Checklist

- Reconcile ITC reversal history

- Match reclaim ledger balances

- Review RCM ITC vs RCM tax payment

- Eliminate negative balances before system enforcement

Mental Shift Required

GST is no longer form-based.

It is ledger-controlled compliance.

Common Blind Spots You Must Stop Ignoring

- Assuming warnings mean “optional”

- Ignoring negative balances because filing is still allowed

- Treating RCM ITC like normal ITC

- Believing future amendments will save you

They won’t.

Final Word: Read This Carefully

GSTN has given enough transition time.

The next phase is non-negotiable enforcement.

If your ITC does not reconcile ledger-to-return, your GSTR-3B will not move.

This is not harsh.

This is overdue discipline.

Need Practical Reconciliation Formats, Working Files, or Video Explanations?

Stay connected with CA Devesh Thakur for structured GST compliance guidance, real-case explanations, and professional-level insights that go beyond surface-level advisories.