Day 27 – GST Basics Explained

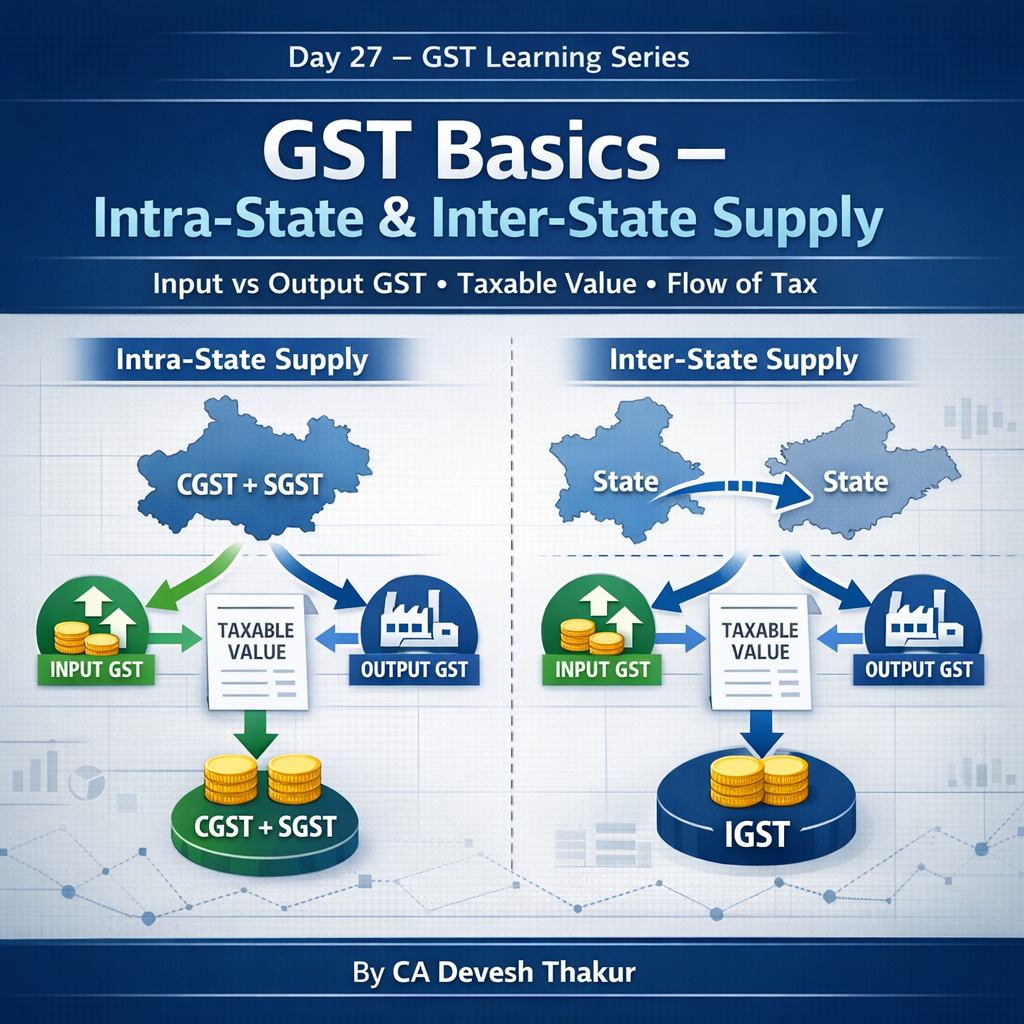

Intra-State & Inter-State Supply, Input vs Output GST, Taxable Value & Flow of Tax

Part of the 50 Days Accounting Challenge

Introduction

Goods and Services Tax (GST) is often perceived as complicated, not because the law is difficult, but because the conceptual flow is not understood clearly. Students usually memorise definitions without understanding how GST actually moves from purchase to sale and finally to the government.

This blog explains GST from the ground up, focusing on:

- What GST is

- Why it is called an indirect and destination-based tax

- What “supply” means under GST

- Taxable value on which GST is levied

- Intra-state vs inter-state supply

- Input GST, Output GST, and adjustment mechanism

All concepts are inter-related and explained using one simple illustration for clarity.

1. What is GST?

GST (Goods and Services Tax) is an indirect tax levied on the supply of goods and services in India.

What is an Indirect Tax?

An indirect tax is a tax where:

- The person who pays the tax and

- The person who bears the burden of the tax

are not the same.

Under GST:

- The seller collects tax from the customer

- The seller deposits it with the government

- The final burden is borne by the consumer

Example:

When you buy goods worth ₹1,000 plus GST, you pay the tax, but the seller acts only as a tax collector.

2. GST as a Destination-Based Tax

GST is a destination-based tax, meaning the tax revenue goes to the state where goods or services are consumed, not where they are produced or supplied from.

Example:

- Seller located in Delhi

- Buyer located in Gujarat

Although the seller is in Delhi, the goods are consumed in Gujarat. Therefore, GST revenue belongs to Gujarat.

Key takeaway:

GST follows place of consumption, not place of origin.

3. GST is Levied on “Supply”, Not Merely on Sale

GST is not restricted to the word “sale”. It is levied on supply.

What is Supply?

Supply includes:

- Sale of goods

- Sale of services

- Transfer, exchange, or barter

- Any transaction made in the course or furtherance of business

If there is no supply, there is no GST liability (subject to exceptions prescribed under law).

Important Concept:

GST is a transaction-based tax, not merely a sales tax.

4. Taxable Value – Value on Which GST is Charged

GST is not always charged on the total invoice amount. It is charged on the taxable value.

Taxable Value Includes:

- Basic price of goods or services

- Packing charges

- Incidental expenses charged to the customer

Taxable Value Excludes:

- Permissible discounts (subject to conditions)

Example:

- Goods price: ₹10,000

- Packing charges: ₹500

Taxable Value = ₹10,500

If GST rate is 18%, then:

GST = ₹10,500 × 18% = ₹1,890

Key line for students:

GST is levied on taxable value, not merely on MRP or final bill amount.

5. Intra-State and Inter-State Supply

The type of GST charged depends on whether the supply is within the same state or between different states.

(A) Intra-State Supply

- Location of supplier and place of supply are in the same state

- Example: Delhi → Delhi

- Taxes charged:

- CGST (Central GST)

- SGST (State GST)

(B) Inter-State Supply

- Location of supplier and place of supply are in different states

- Example: Delhi → Gujarat

- Tax charged:

- IGST (Integrated GST)

Simple Rule:

- Same State = CGST + SGST

- Different States = IGST

6. Input GST and Output GST – Flow of Tax

GST operates on a credit mechanism, ensuring tax is paid only on value addition.

Output GST

- GST charged by a seller on outward supply (sales)

- It is a liability payable to the government

Input GST

- GST paid by a buyer on inward supply (purchases)

- Eligible input GST can be claimed as Input Tax Credit (ITC)

Basic Principle:

Input GST is adjusted against Output GST.

7. Comprehensive Illustration (Interlinking All Concepts)

Scenario:

Mr. A is a registered dealer located in Delhi.

Step 1: Purchase (Intra-State Supply)

Mr. A purchases goods from a supplier in Delhi.

- Purchase value: ₹10,000

- GST @ 18%

- CGST @ 9% = ₹900

- SGST @ 9% = ₹900

Input GST = ₹1,800

This GST is eligible for input tax credit (subject to conditions).

Step 2: Sale (Inter-State Supply)

Mr. A sells goods to a customer in Gujarat.

- Sale value: ₹15,000

- GST @ 18%

- IGST = ₹2,700

Output GST = ₹2,700

Step 3: Adjustment of Input GST Against Output GST

- Output IGST liability: ₹2,700

- Less: Input GST credit: ₹1,800

Net GST Payable = ₹900

This balance ₹900 is paid in cash.

Important Concept:

A business pays GST from its own pocket only when input credit is insufficient.

8. Role of Registered and Unregistered Buyers

- GST liability arises on supply, irrespective of whether the buyer is registered or unregistered

- Registration of buyer affects credit eligibility, not seller’s obligation to pay output GST

Seller must charge GST wherever applicable.

Conclusion: GST in One Logical Flow

- GST is an indirect, destination-based tax

- Levied on supply of goods and services

- Charged on taxable value

- Intra-state supply → CGST + SGST

- Inter-state supply → IGST

- Input GST reduces Output GST

- Only the net balance is paid to the government

Understanding this flow-based structure removes fear and confusion from GST.

Part of: 50 Days Accounting Challenge – Day 27

Concept clarity today builds compliance confidence tomorrow.