Angel One Q3 FY26 Results Explained: From Broking to a Full‑Stack Fintech Platform

Angel One’s Q3 FY26 investor presentation clearly signals a strategic inflection point. The company is no longer just a discount broker riding market volumes. It is positioning itself as a full‑stack, AI‑driven fintech platform with diversified revenue streams, improving margins, and growing annuity income. This blog breaks down the key takeaways, what actually matters beneath the headline numbers, and what it means from a business and platform perspective.

1. Financial Performance: Profitable Growth Is Back

Angel One reported a strong sequential recovery in profitability during Q3 FY26, indicating that the core business has absorbed regulatory changes and is regaining operating leverage.

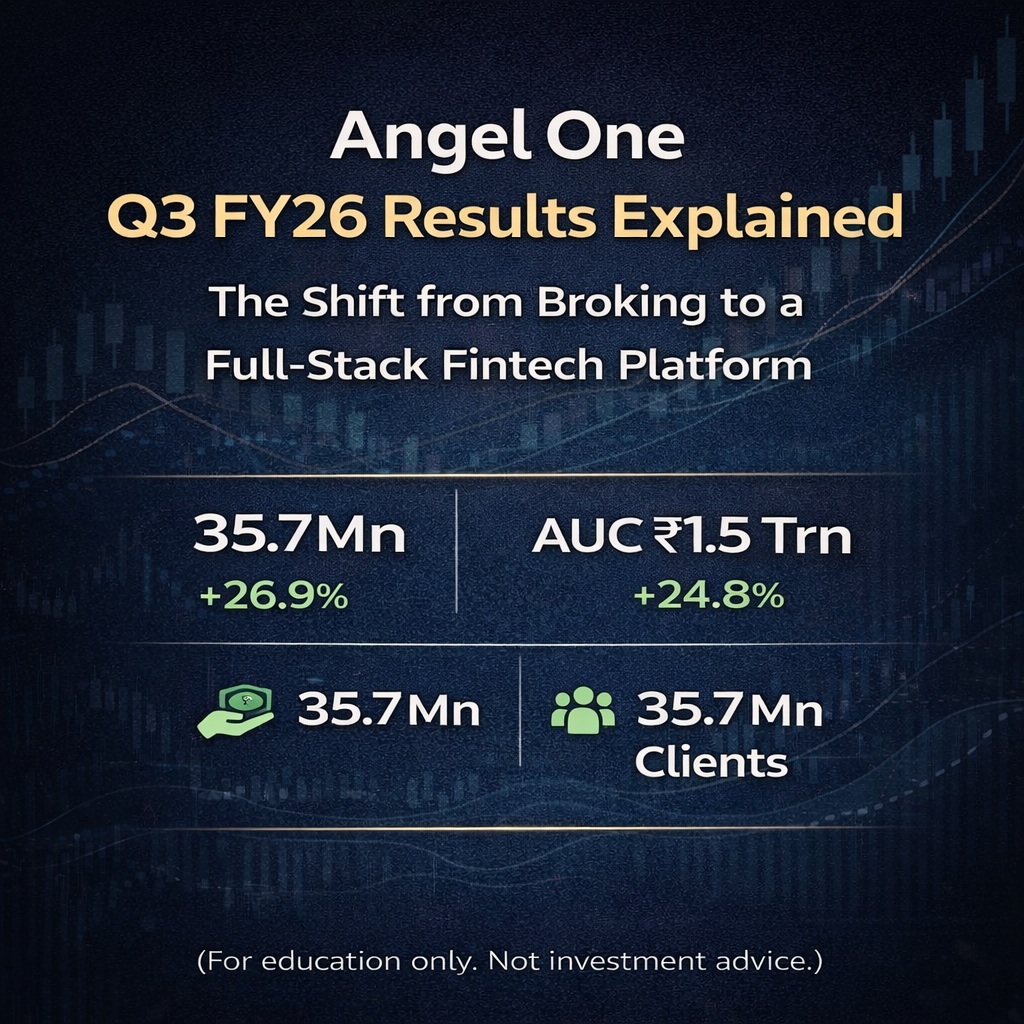

Key numbers (QoQ):

- Profit After Tax (PAT): ₹2.7 billion, up 26.9%

- EBDAT: ₹4.1 billion, up 24.8%

- EBDAT margins moved back towards the 40%+ range

- TTM EPS stood at ₹85 per share

The improvement in margins is important. It suggests that growth is no longer being bought at the cost of profitability. Cost structures are stabilising, and the platform is benefiting from scale and higher monetisation per client.

2. Scale and Market Position: Leadership Is Consolidating

Angel One continues to strengthen its position in India’s retail investing ecosystem.

Platform scale highlights:

- Total client base: 35.7 million

- Demat account market share: 16.5%

- Retail equity turnover market share: 20.4%

- Number of orders executed during the quarter: 380 million

These figures reinforce one key point: Angel One is not just growing with the market, it is gaining share. In a heavily competitive broking industry, sustained market‑share expansion indicates strong platform reliability, distribution strength, and customer stickiness.

3. Broking Is Stable, But Not the Only Story

Broking remains the core engine, but it is no longer the sole driver of growth.

- Average client funding book increased to ₹59 billion

- Engagement remains strong across direct and assisted channels

- Regulatory headwinds in F&O have largely been absorbed

What stands out is that broking revenues are becoming more stable rather than explosive. This is intentional. The company is clearly prioritising durability over short‑term volume spikes.

4. The Real Growth Engines: Beyond Broking

The most important part of the Q3 FY26 presentation lies outside traditional broking.

Wealth Management

- Assets under management (AUM): ₹82.2 billion

- QoQ growth: 33.7%

Angel One’s wealth vertical is scaling rapidly, supported by relationship managers, digital journeys, and AI‑assisted advisory. This business brings higher ticket sizes, longer client lifecycles, and more predictable revenue.

Asset Management

- AMC AUM: ₹4.7 billion

- QoQ growth: 16.7%

- Focus on passive and index‑based products

Passive investing is a long‑term structural trend in India. Angel One is positioning itself early to benefit from annuity‑style AMC revenues.

Credit

- Credit disbursed during the quarter: ₹7.1 billion

- QoQ growth: 55.7%

- Secured lending with strong risk controls

Credit is emerging as a meaningful monetisation lever. The key comfort factor here is disciplined underwriting and negligible NPAs so far.

5. Platform and AI: The Structural Advantage

Angel One’s strategy is clearly platform‑first, not product‑first.

- AI‑powered omnichannel platform

- Proprietary AI tools such as “Ask Angel” for customer queries

- Data‑led personalisation to increase lifetime value per client

- Scalable, low‑latency, high‑uptime technology infrastructure

AI is not being positioned as a buzzword but as an efficiency and engagement driver. Reduced support costs, faster decision‑making, and higher client retention are the real benefits.

6. Revenue Mix Is Improving

A key positive trend is the gradual diversification of revenue sources:

- Declining dependence on pure broking revenues

- Rising contribution from interest income and distribution

- Growing annuity‑style revenues from wealth and AMC businesses

This shift reduces earnings volatility and makes the business more resilient across market cycles.

7. Big Picture: What This Means

Angel One’s Q3 FY26 results confirm three things:

- The broking business has matured and stabilised post regulation.

- New verticals are scaling fast enough to matter.

- The platform model is improving unit economics and revenue durability.

The company is clearly moving from a transaction‑driven model to a lifecycle‑driven model, where the same client is monetised across trading, investing, wealth, credit, and asset management.

Conclusion

Angel One is no longer just a high‑growth broker dependent on market volumes. It is evolving into a diversified fintech platform with improving margins, multiple growth engines, and increasing annuity income.

Q3 FY26 was not just a good quarter in numbers — it was a validation of strategy.

Finlearn Talk by CA Devesh Thakur

(For education only. Not investment advice.)