Accounting of GST: A Beginner’s Guide for Class 11 Students

(Day 30 – 50 Days Accounting Challenge)

By CA Devesh Thakur

Introduction

Goods and Services Tax (GST) is one of the most important topics in modern accounting.

For students studying Class 11 Accountancy, GST is often the first exposure to tax-based accounting, and confusion usually starts right from the basics.

This blog explains the core fundamentals of GST accounting in a step-by-step manner, exactly as a beginner should understand it.

No advanced provisions, no legal overload—only concepts that build a strong foundation.

What is GST?

GST stands for Goods and Services Tax.

It is an indirect tax levied on the supply of goods and services in India.

In simple terms:

Whenever goods are sold or services are provided, GST is charged on the value of supply and collected for the Government.

GST has replaced multiple indirect taxes and follows the principle of “tax on value addition.”

Role of Government in GST

The Government is the central authority in the GST system. Its role includes:

- Defining what constitutes goods and services

- Prescribing GST rates

- Issuing HSN and SAC codes

- Fixing threshold limits for registration

- Allowing Input Tax Credit (ITC)

All GST collected by businesses ultimately belongs to the Government, not the seller.

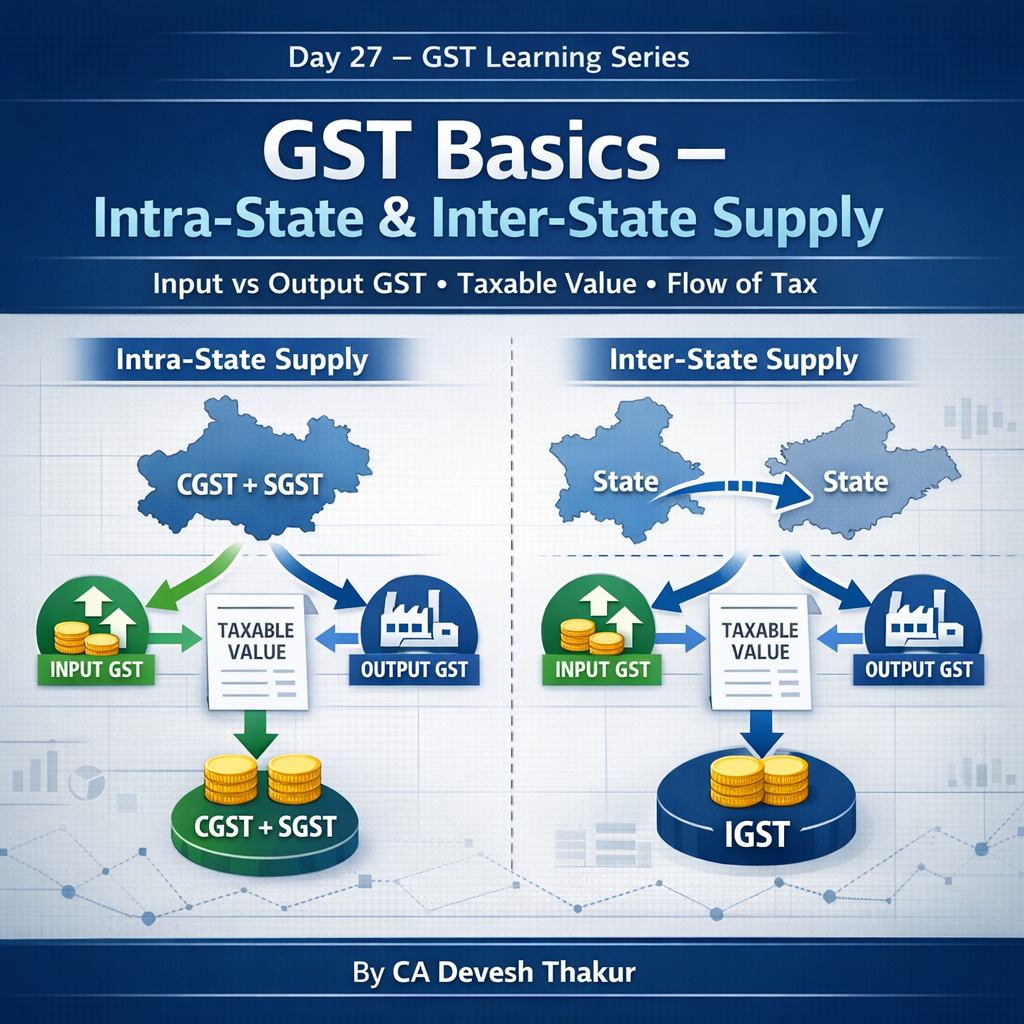

Understanding the GST Flow: Supplier → Seller → Buyer

To understand GST accounting, one must first understand the flow of transactions.

1. Supplier

A supplier provides goods or services to a business.

The supplier charges GST on the invoice.

2. Seller (Business Entity)

The seller:

- Purchases goods/services (pays GST → Input Tax)

- Sells goods/services (charges GST → Output Tax)

3. Buyer

The buyer pays the final price including GST.

GST flows forward, while tax credit flows backward.

Goods and Services under GST

GST applies to two broad categories:

Goods

Goods are tangible items that can be seen, touched, and stored.

Examples:

- Furniture

- Machinery

- Mobile phones

Services

Services are intangible activities performed for consideration.

Examples:

- Legal services

- Transport services

- Teaching services

HSN and SAC Codes: Why They Matter

To ensure uniform classification, GST uses standardized codes.

HSN (Harmonised System of Nomenclature)

- Used for goods

- Helps identify the correct GST rate

SAC (Services Accounting Code)

- Used for services

- Ensures proper tax classification

These codes are crucial because GST rates depend on them.

GST Rates

Not all goods and services are taxed at the same rate.

The Government specifies GST rates such as:

- 5%

- 18%

The seller does not decide the rate.

The applicable rate depends on:

- Nature of goods/services

- HSN or SAC code

Threshold Limit under GST

GST registration is not compulsory for everyone.

The Government has prescribed a threshold turnover limit.

If a business’s turnover:

- Is below the threshold → Registration not mandatory

- Exceeds the threshold → GST registration becomes compulsory

Once registered, the business becomes a Registered Taxable Person.

Output Tax: GST Collected on Sales

When a registered seller sells goods or services and charges GST from the buyer, the tax collected is called Output Tax.

Example:

A seller sells goods worth ₹1,00,000 and charges 18% GST.

Output Tax = ₹18,000

This amount is payable to the Government, subject to adjustment.

Input Tax: GST Paid on Purchases

When a registered seller purchases goods or services and pays GST to the supplier, the tax paid is called Input Tax.

Example:

The seller purchases raw material worth ₹50,000 and pays 18% GST.

Input Tax = ₹9,000

This tax is not a cost if ITC is available.

Input Tax Credit (ITC): The Core of GST Accounting

Input Tax Credit is the heart of GST.

It allows a registered taxpayer to adjust Input Tax against Output Tax.

ITC Calculation Formula

Output Tax

(-) Input Tax

= GST Payable / Refund

Example:

- Output Tax collected: ₹18,000

- Input Tax paid: ₹9,000

GST Payable = ₹9,000

If Input Tax exceeds Output Tax, the excess may be carried forward or refunded as per rules.

Why ITC Exists

Without ITC, tax would be charged multiple times on the same value.

ITC ensures:

- No cascading of taxes

- Tax is levied only on value addition

- Fair taxation system

Accounting Perspective for Students

From an accounting point of view, remember:

- GST collected is not income

- GST paid is not an expense (if ITC is available)

- Only the net GST is payable to the Government

This concept is critical for journal entries in higher classes.

Key Takeaways for Class 11 Students

- GST is charged on supply of goods and services

- Seller collects GST but does not own it

- Input Tax and Output Tax are adjusted using ITC

- Registration depends on threshold limit

- Proper classification using HSN and SAC is essential

Conclusion

Understanding GST accounting is not about memorising laws—it is about understanding flow and logic.

Once the basics are clear, advanced GST concepts become significantly easier.

This blog is designed to build that foundation for students encountering GST for the first time.

About the Author

CA Devesh Thakur is a Chartered Accountant and educator, known for simplifying accounting, GST, and taxation concepts for students and beginners through structured learning challenges.

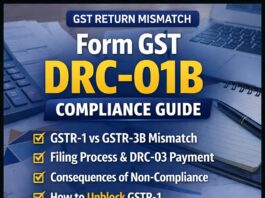

Good. This is where most teachers go soft — and students fail.

Below are practical, exam-oriented questions on Accounting of GST, designed exactly at Class 11 level, moving from easy → scoring → thinker-type.

No unnecessary law. These are marks-fetching questions.

Practical Exam-Oriented Questions

Accounting of GST (Class 11 – Beginners)

🔹 A. Very Basic (1–2 Marks)

- Define GST.

- What is meant by Output Tax under GST?

- What is Input Tax Credit (ITC)?

- State the meaning of HSN Code.

- State the meaning of SAC Code.

- Is GST collected by the seller treated as income? Give reason.

👉 Purpose: Direct definition questions — easy marks.

🔹 B. Concept Application (3–4 Marks)

- Distinguish between Input Tax and Output Tax with one example each.

- Explain the concept of Input Tax Credit with the help of a simple numerical example.

- Why is GST called a tax on value addition? Explain briefly.

- Explain the importance of threshold limit under GST.

🔹 C. Numerical-Based Practical Questions (5–6 Marks)

Question 11

Mr. A purchased goods worth ₹40,000 and paid GST @18%.

He sold the goods for ₹60,000 and charged GST @18%.

Calculate:

(a) Input Tax

(b) Output Tax

(c) Net GST payable

Question 12

A registered trader paid GST of ₹7,200 on purchases and collected GST of ₹10,800 on sales.

Calculate the amount of GST payable to the Government.

Question 13

Following information is given:

| Particulars | Amount (₹) |

| GST on Purchases | 12,500 |

| GST on Sales | 9,800 |

Determine whether GST is payable or refundable and calculate the amount.

🔹 D. Journal Entry Based (High-Scoring)

Question 14

Record the journal entries for the following transactions:

- Purchased goods worth ₹50,000 plus GST @18%.

- Sold goods worth ₹80,000 plus GST @18%.

- Adjust Input Tax Credit against Output Tax.

(Ignore discount and assume GST is eligible for ITC.)

Question 15

Pass journal entries to record GST payable after adjusting Input Tax Credit, where:

- Output GST = ₹15,000

- Input GST = ₹9,000

🔹 E. Case-Based Practical Question (Exam Favourite)

Question 16

Ravi Traders is a registered dealer. During April 2025, the following transactions took place:

- Purchased goods worth ₹1,00,000 plus GST @12%

- Sold goods worth ₹1,40,000 plus GST @12%

You are required to:

- Calculate Input Tax

- Calculate Output Tax

- Compute GST payable

- Explain whether GST is an expense or liability

🔹 F. Assertion–Reason (MCQ Type)

Assertion (A): Input Tax Credit reduces the GST liability of a registered dealer.

Reason (R): GST paid on purchases can be adjusted against GST collected on sales.

Choose the correct option.

🔹 G. Common Trap Questions (Teachers Love These)

- GST paid on purchases is always treated as an expense.

(True / False – Give reason) - A seller decides the GST rate applicable to goods sold.

(True / False – Give reason) - Input Tax Credit can be claimed without GST registration.

(True / False – Give reason)

🔹 H. HOTS (Higher Order Thinking – 6 Marks)

Explain the complete GST cycle from purchase of goods to payment of GST to the Government with the help of a diagram and numerical example.