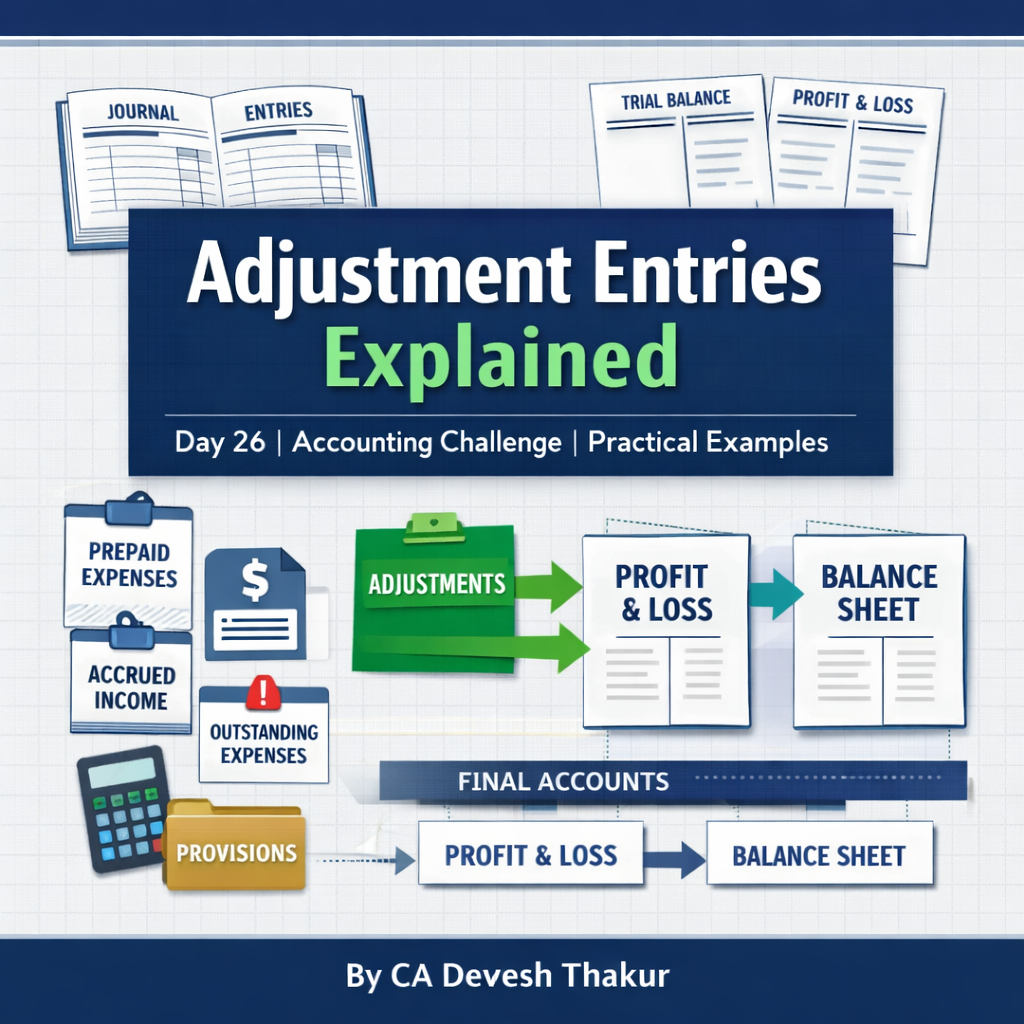

Day 26: Adjustment Entries in Accounting – Meaning, Purpose, Rules, Entries, Examples & Comparison Chart

Introduction: Why Adjustment Entries Matter in Accounting

Many students believe that cash received = income and cash paid = expense.

This is the biggest accounting mistake — and the main reason profits go wrong in exams and real life.

Adjustment entries exist to correct this mistake.

👉 Accounting follows the accrual concept, not the cash concept.

👉 Profit must reflect the correct period, not cash movement.

In Day 26 of the 50 Days Accounting Challenge, we cover Adjustment Entries in a complete, exam-oriented and practical way.

What Are Adjustment Entries?

Adjustment entries are journal entries passed after preparing the Trial Balance but before finalising the accounts, to ensure:

- Correct profit or loss

- Correct assets and liabilities

- Income and expenses are recorded in the right accounting period

In simple words:

Adjustment entries correct incomplete or incorrect information in the Trial Balance.

Purpose of Passing Adjustment Entries

Adjustment entries are passed to:

- Record outstanding and prepaid expenses

- Record accrued and advance incomes

- Account for non-cash expenses like depreciation

- Adjust owner-related items like interest on capital

- Show the true financial position of the business

Without adjustment entries:

❌ Profit will be wrong

❌ Balance Sheet will be misleading

Types of Adjustment Entries (Day 26 Coverage)

This blog covers the following six adjustment entries:

- Outstanding Expenses

- Prepaid Expenses

- Accrued Income

- Income Received in Advance

- Interest on Capital

- Depreciation

Each is explained below in detail.

1. Outstanding Expenses

Meaning

Outstanding expenses are expenses incurred during the accounting year but not yet paid.

Why Adjustment Is Required

Expense belongs to the current year, but payment is pending.

If not adjusted, profit will be overstated.

Accounting Rule

- Debit the expense

- Credit the liability

Journal Entry

Expense A/c Dr

To Outstanding Expense A/c

Impact

- Profit & Loss Account → Expense increases → Profit decreases

- Balance Sheet → Outstanding expense shown as a liability

Example

Salary paid ₹20,000

Outstanding salary ₹3,000

Correct salary expense = ₹23,000

2. Prepaid Expenses

Meaning

Prepaid expenses are expenses paid in advance for a future period.

Why Adjustment Is Required

Payment relates partly to the next accounting year.

Current year profit is shown lower than actual.

Accounting Rule

- Debit the asset

- Credit the expense

Journal Entry

Prepaid Expense A/c Dr

To Expense A/c

Impact

- Profit & Loss Account → Expense decreases → Profit increases

- Balance Sheet → Prepaid expense shown as an asset

Example

Rent paid ₹12,000

Prepaid rent ₹2,000

Expense for current year = ₹10,000

3. Accrued Income (Income Earned but Not Received)

Meaning

Accrued income is income earned during the year but not yet received.

Why Adjustment Is Required

Income belongs to the current year but is missing from books.

Profit is understated.

Accounting Rule

- Debit the asset

- Credit the income

Journal Entry

Accrued Income A/c Dr

To Income A/c

Impact

- Profit & Loss Account → Income increases → Profit increases

- Balance Sheet → Accrued income shown as an asset

Example

Interest earned ₹5,000

Interest received ₹3,500

Accrued income = ₹1,500

4. Income Received in Advance

Meaning

Income received in advance is income received before it is earned.

Why Adjustment Is Required

Cash received does not belong to the current year.

Profit is overstated.

Accounting Rule

- Debit income

- Credit liability

Journal Entry

Income A/c Dr

To Unearned Income A/c

Impact

- Profit & Loss Account → Income decreases → Profit decreases

- Balance Sheet → Unearned income shown as a liability

Example

Rent received ₹10,000

Advance rent ₹2,000

Actual income = ₹8,000

5. Interest on Capital

Meaning

Interest on capital is the return given to the owner for investing capital in the business.

Why Adjustment Is Required

It is:

- Expense for business

- Income for owner

Hence adjustment is necessary.

Accounting Rule

- Debit expense

- Credit capital

Journal Entry

Interest on Capital A/c Dr

To Capital A/c

Impact

- Profit & Loss Account → Expense increases → Profit decreases

- Balance Sheet → Capital increases

Example

Capital ₹1,00,000

Interest @10% = ₹10,000

6. Depreciation

Meaning

Depreciation is the reduction in value of an asset due to use, time, or wear and tear.

Why Adjustment Is Required

Asset has been used to earn income.

Expense must be matched with revenue.

Accounting Rule

- Debit depreciation (expense)

- Credit asset

Journal Entry

Depreciation A/c Dr

To Asset A/c

Impact

- Profit & Loss Account → Expense increases → Profit decreases

- Balance Sheet → Asset value decreases

Example

Furniture ₹50,000

Depreciation @10% = ₹5,000

Closing value = ₹45,000

Comparison Chart: Key Adjustment Entries

| Particulars | Outstanding | Prepaid | Accrued Income | Income in Advance |

| Nature | Expense | Expense | Income | Income |

| Cash Status | Not paid | Paid | Not received | Received |

| P&L Impact | Profit ↓ | Profit ↑ | Profit ↑ | Profit ↓ |

| Balance Sheet | Liability | Asset | Asset | Liability |

Key Exam-Oriented Takeaways

- Adjustment entries follow accrual concept

- Cash movement is irrelevant

- Always ask:

👉 Does it belong to the current year? - Every adjustment affects:

- P&L Account

- Balance Sheet

Final Summary

Adjustment entries ensure that:

- Profit is correct

- Assets and liabilities are accurate

- Financial statements reflect true and fair view

Adjustment entries are passed not for cash, but for correctness.