Effective from 1 April 2026, the Income-tax Act, 2025 will come into force, bringing a completely restructured framework of Income-tax Rules and Forms.

The Central Board of Direct Taxes (CBDT) has released the Draft Income-tax Rules, 2026 along with 190 draft forms for public feedback. The draft remains open for stakeholder comments until 22 February 2026 .

👉 Download Income Tax Rules 2026 – New Forms List

👉 Download New Income Tax Forms 2026 – New Format

This article covers:

- Key structural changes in Income-tax Rules 2026

- Major simplifications introduced

- Technology-driven smart forms

- Reduction in number of rules and forms

- Complete tabular list of all 190 draft forms

Why the New Income-tax Rules 2026 Matter

The drafting philosophy follows the simplified structure of the Income-tax Act, 2025.

Major Structural Changes

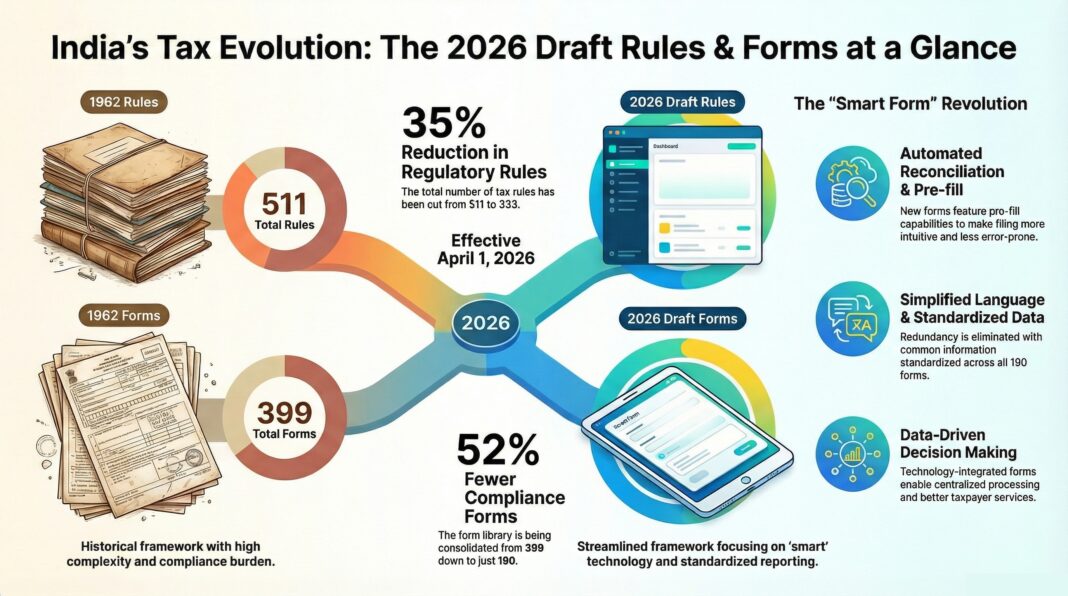

| Particulars | Income-tax Rules 1962 | Draft Income-tax Rules 2026 |

| Total Rules | 511 Rules | 333 Rules |

| Total Forms | 399 Forms | 190 Forms |

| Language | Complex & scattered | Simplified & structured |

| Redundancy | Present | Removed |

| Technology Integration | Limited | Smart, automated & prefilled |

(Source: Draft Note issued by CBDT )

The reduction is not cosmetic. It is structural consolidation and elimination of repetitive compliance.

Core Philosophy of Draft Income-tax Rules 2026

As mentioned in the CBDT note , the reform focuses on:

- Simplified legal language

- Standardised information across forms

- Automated reconciliation capability

- Prefill system for reduced errors

- Centralised processing

- Data-driven decision-making

This signals a shift from compliance-heavy documentation to technology-assisted compliance.

Smart Forms: What Has Changed?

The draft forms have been redesigned to:

- Reduce duplicate information

- Enable automated validation

- Improve user experience

- Support centralised processing

- Minimise interpretation disputes

This is clearly intended to reduce litigation arising from ambiguity.

Full List of Draft Income-tax Forms 2026 (1 to 190)

Below is the complete tabular list extracted from the Draft Forms List document :

Complete Tabular List of Forms

Here is the full tabular list of the Draft Income-tax Forms for 2026 based on the provided sources.

Draft Income Tax Forms List 2026

| Form No. | Form Heading / Description |

|---|---|

| Form No. 1 | Monthly Statement to be furnished by a stock exchange in respect of transactions in which client codes have been modified after registering in the system for the month of ……. |

| Form No. 2 | Application for notification of a zero coupon bond under section 2(112) of the Act |

| Form No. 3 | Certificate of an accountant under rule 7 |

| Form No. 4 | Income attributable to assets located in India under section 9(10)(a) |

| Form No. 5 | Statement regarding preliminary expenses incurred by the assessee to be furnished under Section 44(3) of the Act |

| Form No. 6 | Audit Report under section 44(6) /51(7) of the Income Tax Act 2025 |

| Form No. 7 | Application for approval of scientific research programme under section 45(3)(c) of the Act |

| Form No. 8 | Order of approval of Scientific Research Programme under section 45(3)(c) of the Act |

| Form No. 9 | Receipt of payment for carrying out scientific research under section 45(3) (c) of the Act |

| Form No. 10 | Report to be submitted by the prescribed authority to the Chief Commissioner of Incometax having jurisdiction over the sponsor after approval of scientific research programme under section 45(3)(c) of the Act |

| Form No. 11 | Application for entering into an agreement with the Department of Scientific and Industrial research for cooperation in In-house research development facility and for audit of accounts maintained by the facility |

| Form No. 12 | Report to be submitted by the prescribed authority to the Chief Commissioner of Income-tax having jurisdiction over the company |

| Form No. 13 | Report from an accountant to be furnished under Section 45(2) of the Act relating to in-house scientific research and development facility |

| Form No. 14 | Order of approval of in-house research and development facility under section 45(2) of the Act |

| Form No. 15 | Statement to be filed by research association, university, college or other institution or company ( “donee” ) under section 45(4)(a) of the Act |

| Form No. 16 | Certificate of donation under section- 45(4)(a) of the Act |

| Form No. 17 | Application for approval of a company under section 45(3)(b) and of a research association, university, college or other institution under section 45(4)(b) of the Income-tax Act, 2025 |

| Form No. 18 | Application for notification of affordable housing project as specified business under section 46 of the Act |

| Form No. 19 | Application for notification of a semiconductor wafer fabrication manufacturing unit as specified business under section 46 of the Act |

| Form No. 20 | Application for approval of agricultural extension project under section 47(1)(a) of the Act |

| Form No. 21 | Form for notification of agricultural extension project under section 47(1) (a) of the Act |

| Form No. 22 | Application for approval of skill development project under section 47(1) (b) of the Act |

| Form No. 23 | Form for notification of skill development project under section 47(1)(b) of the Incometax Act, 2025 |

| Form No. 24 | Audit Report under section 59 of the Income-tax Act, 2025 |

| Form No. 25 | Form of daily case register |

| Form No. 26 | Audit report and Statement of particulars required to be furnished under section 63 of the Income-tax Act, 2025 |

| Form No. 27 | Details of amount attributed to capital asset remaining with the specified entity |

| Form No. 28 | Report of an accountant to be furnished by an assessee under Section 77(4) of the Act relating to the computation of capital gains in the case of slump sale |

| Form No. 29 | Certificate from the principal officer of the amalgamated company and duly verified by an accountant regarding achievement of the prescribed level of production and continuance of such level of production in subsequent years |

| Form No. 30 | Certificate of the medical authority for certifying ‘person with disability’, ‘severe disability’, ‘autism’, ‘cerebral palsy’ and ‘multiple disability’ for purposes of section 127 & section 154 of the Act |

| Form No. 31 | Declaration to be filed by the assessee for claiming deduction under section 134 of the Act for rents paid |

| Form No. 32 | Audit report under section 46, 138, 139, 140(8), 141, 142, 143, 144 of the Act |

| Form No. 33 | Particulars to be furnished in respect of units established under SEZ for claiming deduction under section 144 of the Act |

| Form No. 34 | Report for deduction in respect of additional employee cost under section 146 of the Act |

| Form No. 35 | Report for deduction in respect of income of Offshore Banking Units and Units of International Financial Services Centre under section 147(4)(a) of the Act |

| Form No. 36 | Certificate under section 151(5) of the Act for Authors of certain books in receipt of Royalty Income |

| Form No. 37 | Certificate under section 152(5) of the Act for Patentees in receipt of royalty income |

| Form No. 38 | Certificate of foreign inward remittance |

| Form No. 39 | Form for claiming relief under section 157(1) of the Act in case of receipt of additional salary, or gratuity or Retrenchment Compensation or commutation of pension |

| Form No. 40 | Exercise of option for relief from taxation in income from retirement benefit account maintained in a notified country under section 158 of the Act |

| Form No. 41 | Information to be provided under section 159(8) |

| Form No. 42 | Application for Certificate of residence for the purposes of an agreement under section 159(1) and 159(2) |

| Form No. 43 | Statement to be furnished by an eligible investment fund to the Assessing Officer under section 9(12) [Schedule I: Paragraph 1(4)] |

| Form No. 44 | Statement of income from a country or region outside India and Foreign Tax Credit |

| Form No. 45 | Intimation of settlement of dispute regarding foreign tax for which credit has not been claimed |

| Form No. 46 | Exercise of option for determination of arm’s length price (ALP) under section 166(9) |

| Form No. 47 | Certificate of an accountant under section 166 |

| Form No. 48 | Report from an accountant to be furnished under section 172 of the Income-tax Act, 2025 relating to international transaction(s) and/or specified domestic transaction(s) |

| Form No. 49 | Application for opting for Safe Harbour |

| Form No. 50 | Application for a pre-filing consultation |

| Form No. 51 | Application for an Advance Pricing Agreement (APA) |

| Form No. 52 | Annual Compliance Report on Advance Pricing Agreement |

| Form No. 53 | Form for filing particulars of past years for calculating relief in tax payable under section 206(1) |

| Form No. 54 | Application for Renewal of an Advance Pricing Agreement (APA) |

| Form No. 55 | Form of application for an assessee, resident in India, seeking to invoke mutual agreement procedure provided for in agreements with other countries or specified territories |

| Form No. 56 | Information and document to be furnished by the person who is a constituent entity under section 171(4) |

| Form No. 57 | Intimation by a designated constituent entity, resident in India, of an international group, for the purposes of section 171(4) |

| Form No. 58 | Intimation by a constituent entity, resident in India, of an international group, the parent entity of which is not resident in India, for the purposes of section 511(1) |

| Form No. 59 | Report by a parent entity or an alternate reporting entity or any other constituent entity, resident in India, for the purposes of section 511(2) or section 511(4) |

| Form No. 60 | Intimation on behalf of the international group for the purposes of section 511(5) |

| Form No. 61 | Authorisation for claiming deduction in respect of any payment made to any financial institution located in a notified jurisdictional area |

| Form No. 62 | Form for making the reference to the Commissioner of Income-tax by the Assessing Officer under section 274(1) |

| Form No. 63 | Form for returning the reference made under section 274 |

| Form No. 64 | Form for making reference to the Approving Panel and for recording the satisfaction by the Commissioner before making a reference to the Approving Panel under section 274(4) |

| Form No. 65 | Form for opting for taxation of income by way of royalty in respect of patent |

| Form No. 66 | Report for Computation of Book Profit for the purposes of section 206(1) of the Act |

| Form No. 67 | Report for Computation of Adjusted Total Income and Alternate Minimum Tax for the purposes of section 206(2) of the Act |

| Form No. 68 | Statement of exempt income under Schedule VI [Table: Sl. Nos. 1 to 4] |

| Form No. 69 | Statement of income of a Specified fund eligible for concessional taxation under section 210(2) of the Act |

| Form No. 70 | Annual Statement of exempt income and income taxable at concessional rate for an investment division of an offshore banking Unit |

| Form No. 71 | Verification by an Accountant for computation of exempt income of specified fund, attributable to the investment division of an offshore banking unit, for the purposes of Schedule VI of the Act |

| Form No. 72 | Statement of income paid or credited by a securitisation trust to be furnished under section 221 |

| Form No. 73 | Statement of income distributed by a securitisation trust to be provided to the investor under section 221 |

| Form No. 74 | Statement of income paid or credited by Venture Capital Company or Venture Capital Fund to be furnished under section 222 |

| Form No. 75 | Statement of income paid or credited by Venture Capital Company or Venture Capital Fund to be provided to the person who is liable to tax under section 222 |

| Form No. 76 | Statement of income paid or credited by business trust to be furnished under section 223 |

| Form No. 77 | Statement of income distributed by a business trust to be provided to the unit holder under section 223 |

| Form No. 78 | Statement of income distributed by an investment fund to be provided to the unit holder under section 224 |

| Form No. 79 | Statement of income paid or credited by investment fund to be furnished under section 224 |

| Form No. 80 | Application for exercising/renewing option for the tonnage tax scheme under section 231(1) or 231(10) of the Act |

| Form No. 81 | Audit Report under section 232(21) of the Act |

| Form No. 82 | Warrant of authorisation under section 247 of the Act, and rule 148 of the Income-tax Rules, 2026 |

| Form No. 83 | Warrant of authorisation under section 247(2) of the Act |

| Form No. 84 | Warrant of authorisation under section 247(3) of the Act |

| Form No. 85 | Application under section 247(5)/247(9) of the Act |

| Form No. 86 | Warrant of authorisation under section 248(1) of the Act |

| Form No. 87 | Information to be furnished to the income-tax authority under section 254 of the Act |

| Form No. 88 | Application for information under section 258(2)(a) of the Act |

| Form No. 89 | Form for furnishing information under section 258(2) of the Act |

| Form No. 90 | Form for intimating non-availability of information under section 258(2) (a) of the Act |

| Form No. 91 | Refusal to supply information under section 258(2)(a) of the Act |

| Form No. 92 | Quarterly statement to be furnished by specified fund or stock broker in respect of a non-resident referred to in rule 157 for the quarter of [quarter] of [Financial Year] |

| Form No. 93 | Application for Allotment of Permanent Account Number [For an Individual being a Citizen of India] |

| Form No. 94 | Application for Allotment of Permanent Account Number [For an Indian Company / an Entity incorporated in India/ an Unincorporated Entity] |

| Form No. 95 | Application for Allotment of Permanent Account Number [For an Individual not being a Citizen of India] |

| Form No. 96 | Application for Allotment of Permanent Account Number [For an Entity incorporated outside India/ an Unincorporated Entity formed outside India] |

| Form No. 97 | Form for declaration to be filed by any person (other than a company or firm) or a foreign company covered by sub-rule (2) to rule 159 , who does not have a permanent account number and who enters into any transaction specified in rule 159 |

| Form No. 98 | Statement containing particulars of declaration received in Form No. 97 |

| Form No. 99 | Appeal to the Joint commissioner of Income-tax (Appeals) or the Commissioner of Income-tax (Appeals) |

| Form No. 100 | Audit report under section 268(5)(i) of the Act |

| Form No. 101 | Inventory Valuation report under section 268(5) of the Act |

| Form No. 102 | Application under Section 288(1) [Table: Sl. No. 11] for credit of tax deduction at source |

| Form No. 103 | Notice of demand under section 289 of the Act |

| Form No. 104 | Application for provisional registration or provisional approval |

| Form No. 105 | Application for registration of non-profit organisation under section 332 or approval for deduction under section 133(1)(b)(ii) |

| Form No. 106 | Order for provisional registration u/s 332 or provisional approval u/s 354 Rejection of application |

| Form No. 107 | Order for grant of registration under section 332 or approval under section 354 or rejection of application or cancellation of registration or approval granted |

| Form No. 108 | Exercise of option under section 341(7) in respect of amount applied for charitable or religious purposes |

| Form No. 109 | Statement of accumulation or setting apart of income under section 342(1) |

| Form No. 110 | Application for change of purpose of accumulation or setting apart of income under section 342(5) |

| Form No. 111 | Order under section 342(6) on the request for change of purpose of accumulation or setting apart of income |

| Form No. 112 | Audit report under section 348 in the case of a registered non-profit organisation (NPO) |

| Form No. 113 | Statement or Correction Statement to be filed by Donee under section 354(1) |

| Form No. 114 | Certificate of donation under section 354(1)(g) |

| Form No. 115 | Form of appeal to the Appellate Tribunal |

| Form No. 116 | Form of memorandum of cross-objections to the Appellate Tribunal |

| Form No. 117 | Declaration under section 375(1) of the Act to be made by an assessee claiming that identical question of law is pending before the High Court or the Supreme Court |

| Form No. 118 | In the High Court of _______ or Income-tax Appellate Tribunal _______ |

| Form No. 119 | Application to the Dispute Resolution Committee under section 379 of the Act |

| Form No. 120 | Form of application for obtaining an advance ruling section 383(1) of the Act |

| Form No. 121 | Declaration under section 393(6) for receipt of certain incomes without deduction of tax |

| Form No. 122 | Form for furnishing details of income under section 392(4)(a) of the Act |

| Form No. 123 | Statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary with value thereof |

| Form No. 124 | Statement showing particulars of claims by an employee for deduction of tax under section 392(5)(b) of the Act |

| Form No. 125 | Declaration to be furnished by Specified Senior Citizen under Section 393(1) [Table: Sl. No. 8(iii)] |

| Form No. 126 | Application by a person specified in rule 209 for a certificate under section |

| Form No. 127 | Declaration under section 394(2) of the Act to be made by a buyer for obtaining goods without collection of tax |

| Form No. 128 | Application for issuance of certificate for lower/nil deduction of income-tax and lower collection of income-tax under section 395(1) and 395(3) of the Act |

| Form No. 129 | Application by a person for a certificate under section 395(2) and 400(3) of the Act for determination of appropriate proportion of sum (other than salary) payable to non-resident, chargeable to tax in case of the recipient |

| Form No. 130 | Certificate under section 395 of the Act for tax deducted at source on salary paid to an employee under section 392 or pension or interest income of specified senior citizen under section 393(1) [Table: Sl. No. 8(iii)] |

| Form No. 131 | Certificate under section 395(4) of the Act for tax deducted at source |

| Form No. 132 | Certificate under section 395(4) of the Act for tax deducted at source |

| Form No. 133 | Certificate under section 395(4) of the Act for tax collected at source |

| Form No. 134 | Form for application for allotment of Tax Deduction and Collection Account Number [TAN] under section 397 of Act |

| Form No. 135 | Form for application for allotment of Tax Deduction and Collection Account Number [TAN] under section 397 of Act |

| Form No. 136 | Application for allotment of Accounts Office Identification Number (AIN) |

| Form No. 137 | Details of Transfer voucher for the month of (month) (year) |

| Form No. 138 | Quarterly statement of deduction of tax under section 397(3)(b) of the Act in respect of salary paid to employee under section 392, or income of specified senior citizen under section 393(1) [Table: Sl. No. 8(iii)], for the quarter ended ……….. (June/September/December/March) ……. (Tax Year) |

| Form No. 139 | Form to be filed by the deductor, if he claims refund of sum paid under Chapter XIX of the Act |

| Form No. 140 | Quarterly statement of deduction of tax under section 397(3)(b) of the Act in respect of payments made other than salary for the quarter ended……(June/September/December/March) ……. (Tax Year) |

| Form No. 141 | Challan-cum-statement of deduction of tax under section 393(1) [Table Sl. No. 2(i), 3(i), 6(ii) & 8(vi)] |

| Form No. 142 | Quarterly statement of tax deposited in relation to transfer of virtual digital asset under section 393(1) [ Table: S. No. 8(vi)] to be furnished by an Exchange for the quarter ending ……. June/September/December/March of Tax Year |

| Form No. 143 | Quarterly statement of collection of tax at source under Section 397(3)(b) of the Act for the quarter ended…… (June/September/December/March) …… (Tax Year) |

| Form No. 144 | Quarterly statement of deduction of tax under section 397(3)(b) of the Act in respect of payments other than salary made to non-residents for quarter ended……(June/September/December/March) …. (Tax Year) |

| Form No. 145 | Information to be furnished for payments to a non-resident not being a company, or to a foreign company |

| Form No. 146 | Certificate of an accountant for payments to a non-resident, not being a company or to a foreign company |

| Form No. 147 | Quarterly statement to be furnished by an authorised dealer in respect of remittances made for the quarter of …………..of (Tax Year) |

| Form No. 148 | Quarterly statement to be furnished by a unit of an International Financial Services Centre, as referred to in section 147(1)(b), in respect of remittances, made for the quarter of ………….. of (Tax Year) |

| Form No. 149 | Form for furnishing accountant certificate under section 398(2) of the Act |

| Form No. 150 | Form for furnishing accountant certificate under section 398(2) of the Act |

| Form No. 151 | Notice of demand under section 289 of the Act for payment of advance tax under section 407(2) or 407(5) of the Act |

| Form No. 152 | Intimation to the Assessing Officer under section 407(8) regarding the notice of demand under section 289 of the Act for payment of advance tax under section 407(2)/407(5) of the Act |

| Form No. 153 | Certificate under section 413 or 414 of the Act |

| Form No. 154 | Form of undertaking to be furnished under section 420(1) of the Act |

| Form No. 155 | No Objection Certificate for a person not domiciled in India under section 420(1) of the Act |

| Form No. 156 | Form for furnishing the details under section 420(3) of the Act |

| Form No. 157 | Form for furnishing the certificate under section 420(4) of the Act |

| Form No. 158 | Application for Certificate under section 420(5) of the Act |

| Form No. 159 | Clearance Certificate under section 420(5) of the Act |

| Form No. 160 | Application by a person under section 434 of the Act for refund of tax deducted |

| Form No. 161 | Form of application under section 440(2) of the Act |

| Form No. 162 | Annual Statement under section 505 |

| Form No. 163 | Information and Documents to be furnished by an Indian concern under section 506 |

| Form No. 164 | Statement to be furnished under section 507 of the Act by a person carrying on production of a cinematograph film or engaged in specified activity or both |

| Form No. 165 | Statement of Specified Financial Transactions under section 508 (1) of the Income-tax Act, 2025 |

| Form No. 166 | Statement of Reportable Account under section 508(1) of the Income-tax Act, 2025 |

| Form No. 167 | Statement of relevant transaction under section 509 of the Income-tax Act, 2025 |

| Form No. 168 | Annual Information Statement |

| Form No. 169 | Application for registration as a valuer under section 514 of the Act |

| Form No. 170 | Report of valuation of Asset under section 514 of the Act |

| Form No. 171 | Form of application for registration as authorised income-tax practitioner |

| Form No. 172 | Report from an accountant to be furnished for the purpose of section 9(12) [Schedule I: Paragraph 1(4)] regarding fulfilment of certain conditions by an eligible investment fund |

| Form No. 173 | Statement to be furnished by an eligible investment fund to the Assessing Officer under section 9(12) [Schedule I: Paragraph 1(4)] |

| Form No. 174 | Application for notification under Schedule V [Table: Sl. No.7.Note 5(a)(iii) (D)] (Pension Fund) |

| Form No. 175 | Intimation by Pension Fund of investment under Schedule V [Table: Sl. No. 7] (within one month from the end of the quarter ending on 30th June, 30th September, 31st December and 31st March of the financial year) |

| Form No. 176 | Certificate of accountant in respect of compliance to the provisions of Schedule V [Table: Sl. No. 7] by the notified Pension Fund |

| Form No. 177 | Statement of eligible investment received |

| Form No. 178 | Statement of exempt income under Schedule VI [Table: Sl. No. 10] |

| Form No. 179 | Certificate to be issued by the accountant under Schedule VI [Table: Sl. No. 10] |

| Form No. 180 | Application for grant of approval to a fund referred to in Schedule VII [Table: Sl. No. 2] |

| Form No. 181 | Audit report under rule 289(12) in the case of the electoral trust |

| Form No. 182 | Audit Report under paragraph 2 of Schedule IX |

| Form No. 183 | Audit Report under paragraph 2 of Schedule X |

| Form No. 184 | Form of nomination/modifying nominations for Provident/Gratuity Fund |

| Form No. 185 | Form for maintaining accounts of subscribers to a recognised provident fund |

| Form No. 186 | Application for recognition of provident fund under Part A of the Eleventh Schedule of the Act |

| Form No. 187 | Appeal against refusal to recognize or withdrawal of recognition from a provident fund/refusal to approve or withdrawal of approval from a superannuation fund or from a gratuity fund |

| Form No. 188 | Application for Approval of Superannuation Fund/ Gratuity Fund |

| Form No. 189 | Application for approval of issue of public companies under section Schedule XV: Paragraph 1(z)(i) of the Act |

| Form No. 190 | Application for approval of mutual funds investing in the eligible issue of public companies under section Schedule XV: Paragraph 1(z)(ii) of the Act |

Navigators Provided by CBDT

CBDT has also issued:

- Mapping of Old Rules to Draft Rules

- Mapping of Old Forms to Draft Forms

This helps professionals transition from the 1962 framework to the 2026 structure .

Impact Analysis

For Tax Professionals

- Consolidated rule structure

- Reduced interpretation disputes

- Tech-enabled filing

- Standardised documentation

For Businesses

- Ease of compliance

- Lower administrative burden

- Smart automation

- Reduced duplication

For Government

- Centralised data

- Faster processing

- Better analytics

- Reduced litigation

Final Thoughts

This is not just renumbering.

It is structural consolidation, compliance simplification, and digitisation of tax administration.

From 511 Rules & 399 Forms to 333 Rules & 190 Forms — this is one of the largest restructurings in Indian direct tax compliance history .

Professionals should begin reviewing form-wise changes immediately to prepare for FY 2026-27 transition.

📥 Download Official Draft Documents – Income-tax Rules 2026

For in-depth review and professional reference, download the complete draft documents released for stakeholder consultation:

🔹 Navigator – Income-tax Forms 2026

Mapping of old forms to new draft forms for smooth transition and structural comparison.

👉 Download Navigator – Income-tax Forms 2026

🔹 Draft Income-tax Rules and Forms 2026

Official draft note explaining the philosophy, simplification, consolidation, and structural changes under the Income-tax Act, 2025.

👉 Download Draft Income-tax Rules and Forms 2026

🔹 New Income Tax Forms List 2026

Complete consolidated list of all 190 draft forms from Form 1 to Form 190 under the new framework.

👉 Download New Income Tax Forms List 2026

The Great Tax Reset: 5 Surprising Ways India is Reimagining Compliance for 2026

1. Introduction: The End of Tax-Filing Dread?

For decades, the Indian tax season has been synonymous with “compliance dread”—a period defined by a labyrinth of archaic legal jargon and a heavy fog of administrative complexity. That era is officially ending. The administration is not merely updating the software; it is architecting a fundamental shift in the state-citizen relationship. With the Income-tax Act, 2025, set to take effect on April 1, 2026, alongside the newly drafted Income-tax Rules, 2026, we are witnessing a move away from legacy friction toward a streamlined, digital-first fiscal ecosystem.

2. The 50% Reduction: Cutting Compliance Overhead in Half

The most visible indicator of this “reset” is the aggressive pruning of the regulatory thicket. By auditing and consolidating decades of redundant requirements, the government has slashed the volume of compliance material by more than half.

The data marks a massive victory for structural efficiency:

- Rules: Streamlined from 511 rules in the 1962 version to just 333 rules.

- Forms: Condensed from 399 legacy forms to a lean 190 forms.

As a strategist, I view this as a direct reduction in “man-hours” and “administrative overhead” for SMEs and corporations alike. This is not just a cleanup; it is a calculated move to boost “ease of business” by lowering the cost of compliance.

“The drafting of new Income-tax Rules and forms has followed the same philosophy as that of the new Income-tax Act 2025. The language of the rules has been simplified to the extent possible. Redundancy in the Income-tax Rules, 1961 has been sought to be eliminated.”

3. The Rise of the “Smart Form”

The 2026 framework marks the death of the static, passive form. The new “Smart Forms” are sophisticated fintech tools designed for a high-velocity economy. By shifting the paradigm from post-facto auditing to real-time validation, the tax department is effectively automating accuracy.

The system integrates three core technological pillars:

- Pre-fill Capabilities: Dynamically populating data to minimize manual entry.

- Automated Reconciliation: Enabling real-time cross-referencing against existing records.

- Centralized Processing: Leveraging data-driven decision-making to eliminate jurisdictional bias and ensure objective, consistent outcomes for all taxpayers.

4. Strategic Tracking: From Semiconductors to Digital Assets

A nation’s tax forms are a blueprint of its economic priorities. The ‘Draft Income-Tax Forms List’ for 2026 reveals a government actively positioning India at the center of the global tech supply chain.

- Form No. 19 (Semiconductor wafer fabrication): By creating a dedicated notification process for semiconductor manufacturing, the administration is architecting a “fast-track” regulatory lane for critical infrastructure, signaling India’s readiness to lead in global hardware production.

- Form No. 142 (Transfer of virtual digital assets): This quarterly statement for tax deposited on digital asset transfers provides the necessary regulatory architecture for a burgeoning digital economy, ensuring that emerging asset classes are integrated into the formal fiscal framework.

5. A Pillar of Inclusivity: “Ease of Living” through Standardization

The 2026 reset recognizes that compliance is not just a business hurdle, but a social one. Under the policy pillar of “Ease of Living,” the framework simplifies access to critical social supports.

- Form No. 30: This unified medical authority certificate covers individuals with disability, severe disability, autism, cerebral palsy and multiple disability. Standardizing this form removes the bureaucratic trauma often associated with securing social benefits.

- Form No. 18: Dedicated to affordable housing projects, this form streamlines the notification process for developers, accelerating the delivery of essential housing.

By simplifying the language and requirements for these specific needs, the state is making social safety nets more accessible to those who need them most.

6. Eliminating Ambiguity Through Mathematical Precision

Administrative friction often stems from “Notes to forms” that are as confusing as the forms themselves. The 2026 framework addresses this by simplifying these notes and replacing subjective legalese with mathematical certainty. Common information has been standardized across all 190 forms, ensuring that taxpayers never have to provide the same data twice.

According to the Note – Draft Income-tax Rules & Forms, 2026:

“Formulas and tables have been provided wherever necessary… The language of the forms has also been simplified so as to avoid any operational, administrative or legal ambiguity. Notes to forms have been simplified.”

This precision is designed to reduce litigation and provide a clear, predictable roadmap for compliance, essentially “debugging” the tax code.

7. Conclusion: A Participative Future

The shift toward the 2026 framework represents the evolution of “subordinate legislation” into a participative process. The CBDT is not just issuing mandates; it is inviting the public to help refine the engine of the economy, with feedback lines open until February 22, 2026.

This transition suggests a future where the tax department is no longer a feared auditor, but a digital partner in a nation’s growth. As we approach this “Great Reset,” the question remains: will this newfound clarity finally transform the taxpayer’s relationship with the state into one of mutual trust and efficiency?