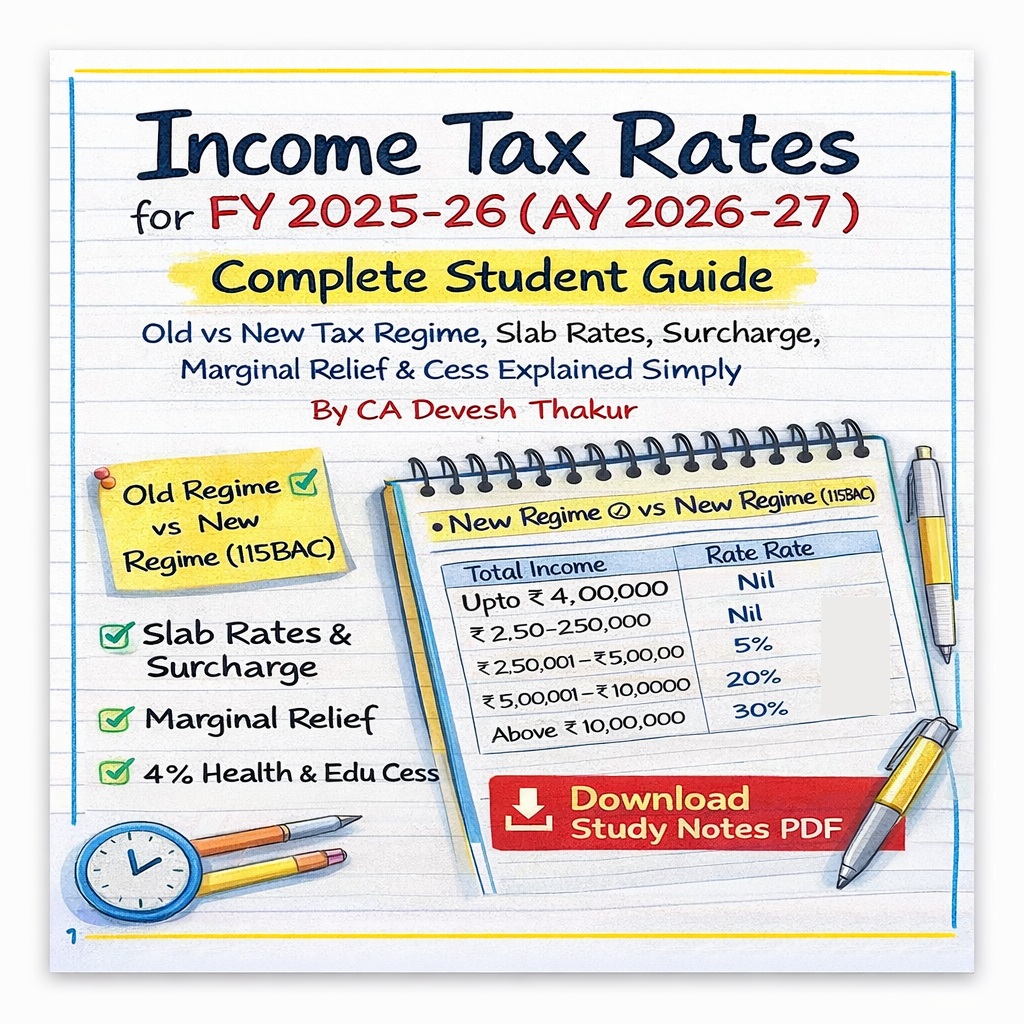

Income Tax Rates for FY 2025-26 (AY 2026-27): Complete Student-Friendly Guide

By CA Devesh Thakur

Understanding income tax rates is not about memorising numbers—it’s about understanding which regime applies, when surcharge kicks in, and how marginal relief saves tax. This guide simplifies the Income-tax provisions for FY 2025-26 (AY 2026-27) in a clear, exam-ready manner for students, CA aspirants, and professionals.

1. Income Tax Regimes – The Foundation You Must Get Right

There are two tax regimes under the Income-tax Act:

Old Tax Regime

- Allows deductions and exemptions (80C, 80D, HRA, etc.)

- Slab rates remain unchanged

- Taxpayer must opt in explicitly

New Tax Regime – Section 115BAC(1A)

- Fewer deductions

- Revised slab rates

- Default regime from AY 2024-25 onwards

👉 If a taxpayer does not exercise any option, tax will be calculated automatically under the New Tax Regime.

2. Income Tax Slabs – New Tax Regime (Default)

| Total Income | Rate of Tax |

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Exam tip:

New regime = Section 115BAC(1A) + default option

👉 Download the PDF – Income Tax Rates FY 2025-26 / AY 2026-27 by CA Devesh Thakur

3. Income Tax Slabs – Old Tax Regime

(A) Individual / HUF (Below 60 years)

| Total Income | Rate |

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

(B) Senior Citizen (60–80 years)

| Total Income | Rate |

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

(C) Super Senior Citizen (80 years & above)

| Total Income | Rate |

| Up to ₹5,00,000 | Nil |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

4. Surcharge – Applicable on High Income

Surcharge is an additional tax on income tax when income crosses specified limits.

General Surcharge Rates

| Total Income | Surcharge |

| ₹50 lakh – ₹1 crore | 10% |

| ₹1 crore – ₹2 crore | 15% |

| ₹2 crore – ₹5 crore | 25% |

| Above ₹5 crore | 37% |

5. Critical Surcharge Restrictions (Highly Exam-Relevant)

These limits are commonly tested and frequently misunderstood:

- New Tax Regime (115BAC)

👉 Maximum surcharge capped at 25% - Capital gains & dividend income (Sections 111A, 112, 112A)

👉 Surcharge capped at 15% - AOP consisting only of companies

👉 Surcharge capped at 15%

6. Marginal Relief – Protection Against Sudden Tax Jumps

Marginal relief ensures that:

Total tax payable (including surcharge) does not exceed the income exceeding the threshold.

It applies when income crosses:

- ₹50 lakh

- ₹1 crore

- ₹2 crore

- ₹5 crore

This prevents unfair spikes in tax liability.

7. Health & Education Cess

- 4% on:

- Income tax

- Plus surcharge (if applicable)

- Levied in all cases

- No exemption, no cap

8. Quick Revision Pointers (For Exams)

- New tax regime = default

- Section 115BAC(1A)

- Surcharge max 25% in new regime

- Capital gains surcharge max 15%

- Cess always 4%

- Marginal relief avoids tax shock

Conclusion

For FY 2025-26 (AY 2026-27), the law clearly favours simplicity through the New Tax Regime, while still allowing flexibility via the Old Regime. Students must focus not just on slab rates, but also on surcharge limits, marginal relief, and default applicability, as these areas are frequently tested and misunderstood.