Opt-In Declaration for Specified Premises under GST – Complete Guide (FY 2026–27)

GST Update by CA Devesh Thakur

Updated on 4 January 2026

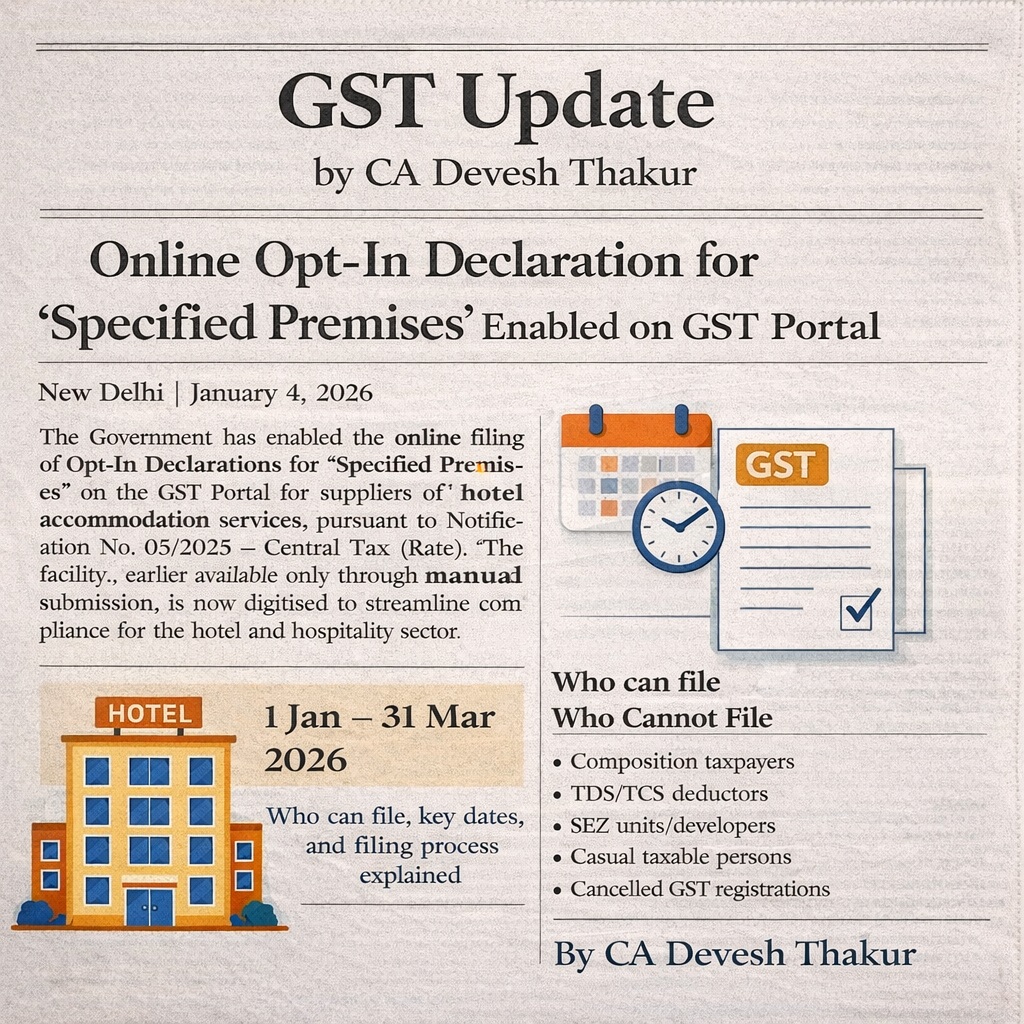

The Government has operationalised the online facility for filing the Opt-In Declaration for Specified Premises on the GST Portal pursuant to Notification No. 05/2025 – Central Tax (Rate) dated 16 January 2025. This change directly impacts hotels, resorts, lodges, and all suppliers of hotel accommodation services.

This Google AdSense-ready guide explains the concept, applicability, timelines, filing process, and compliance impact in a clear and practical manner.

What Are “Specified Premises” Under GST?

Under GST law, hotel accommodation services are classified based on whether the premises qualify as specified premises.

A premises will be treated as a specified premises if any one of the following conditions is satisfied:

- Any unit of accommodation was supplied at a value exceeding ₹7,500 per unit per day in the preceding financial year, or

- The supplier opts in by filing the prescribed declaration within the allowed time, or

- A person applying for GST registration files the declaration within 15 days of ARN generation.

Once a premises is declared as specified premises, the applicable GST rate structure changes, and this status continues automatically for future years unless an opt-out declaration is filed.

Why the Opt-In Declaration Is Important

Many hotel businesses do not cross the ₹7,500 threshold every year. However, GST law allows such taxpayers to voluntarily declare their premises as specified premises.

This declaration is not a procedural formality. It directly affects:

- GST rate applicability

- Classification of hotel accommodation services

- Audit and litigation exposure

- Long-term compliance position

Missing the declaration window can lead to wrong tax application and disputes during GST audits.

Who Is Eligible to File the Declaration?

Eligible Taxpayers

The opt-in declaration can be filed by:

- Regular GST taxpayers (Active or Suspended)

- Persons supplying hotel accommodation services

- Applicants for new GST registration intending to provide hotel accommodation services

Taxpayers Not Eligible

The facility is not available to:

- Composition scheme taxpayers

- TDS or TCS deductors

- SEZ units or SEZ developers

- Casual taxable persons

- Taxpayers with cancelled GST registrations

A cancelled GSTIN cannot file the declaration under any circumstances.

Types of Declarations Available on the GST Portal

The GST Portal now supports the following declarations electronically:

Annexure VII – Opt-In Declaration for Registered Persons

- Applicable to existing registered taxpayers

- Used to declare premises as specified premises for a subsequent financial year

- Filed once, but continues to apply unless opted out

Annexure VIII – Opt-In Declaration for Persons Applying for Registration

- Applicable to new GST registration applicants

- Must be filed within 15 days of ARN generation

- Effective from the date of registration

Annexure IX – Opt-Out Declaration

- Used to withdraw specified premises status

- Will be enabled separately on the GST Portal

Critical Timelines You Must Not Miss

Existing Registered Taxpayers (Annexure VII)

- Filing window: 1 January to 31 March of the preceding financial year

- For FY 2026–27, the declaration can be filed from:

1 January 2026 to 31 March 2026

Failure to file within this window means the option is lost for the entire financial year.

New GST Registration Applicants (Annexure VIII)

- Must be filed within 15 days from the date of ARN generation

- Filing is allowed even if GSTIN is not yet allotted

- Filing is not allowed if the registration application is rejected

If the 15-day period lapses, the applicant must wait until the next January–March window.

Step-by-Step Process to File Declaration on GST Portal

- Log in to www.gst.gov.in

- Navigate to:

Services → Registration → Declaration for Specified Premises - Select Opt-In Declaration for Specified Premises

- Choose eligible premises (maximum 10 per declaration)

- Submit the declaration using EVC

- On successful submission:

- ARN is generated

- Email and SMS confirmation is sent to authorised signatories

Important Compliance Points to Remember

- Maximum 10 premises can be selected in one declaration

- Separate reference numbers and PDFs are generated for each premises

- Additional declarations can be filed for remaining premises within the same window

- Suspended GST registrations are allowed to file

- Cancelled registrations are strictly barred

- The declaration continues for future years unless Annexure IX (Opt-Out) is filed in time

Special Note for FY 2025–26 Taxpayers

For FY 2025–26, opt-in declarations were filed manually with jurisdictional GST authorities. With the launch of the online facility, such taxpayers are required to:

- Re-file Annexure VII electronically for FY 2026–27

- Filing period: 1 January 2026 to 31 March 2026

Non-filing may result in incorrect GST rate application and compliance disputes.

Final Takeaway

The Opt-In Declaration for Specified Premises is a high-impact GST compliance requirement for hotels and accommodation service providers.

Timely filing ensures:

- Correct GST rate application

- Reduced audit risk

- Compliance certainty

Taxpayers should review their premises status immediately and complete the declaration well before 31 March 2026.