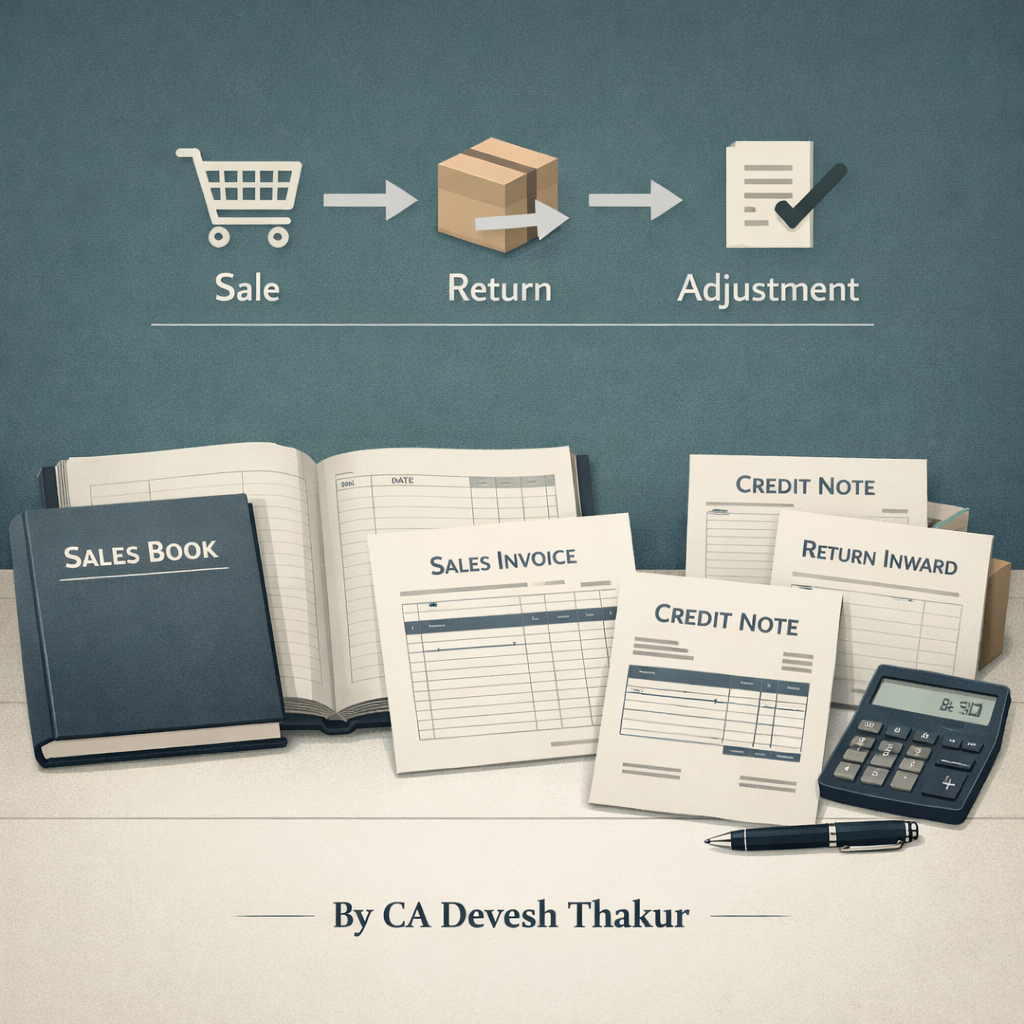

Sales Book, Sales Return & Credit Note Explained

Class 11 Accounting| Day 24 of 50 Days Accounting Challenge| Complete Practical Guide by CA Devesh Thakur

Accounting tab easy lagti hai jab concepts real business se connect hote hain.

Is blog me hum detail me samjhenge:

- Sales Book (Sales Journal)

- Difference between Sales Book & Sales Account

- Sales Return (Return Inward)

- Credit Note – concept & use

- Practical illustrations (December 2025)

- Journal entries with narration

Ye content specially designed hai Class 11 students aur accounting beginners ke liye.

1️⃣ Sales Book (Sales Journal)

🔹 Meaning (Hinglish)

Sales Book ek subsidiary book hai jisme sirf credit sales of goods record hoti hain.

✔ Goods ka matlab → resale ke liye beche gaye items

✔ Credit sale → customer paisa baad me pay karega

❌ Cash sales yahan record nahi hoti

❌ Asset sale (old machine, furniture) yahan include nahi hota

👉 Simple words me:

“Jab business udhaar par maal bechta hai, to uska record Sales Book me hota hai.”

🔹 Format – Sales Book

| Date | Customer Name | Invoice No. | Details | Amount (₹) |

🔹 Practical Illustration (December 2025)

6 December 2025 ko Amit Stores ko credit par goods beche ₹50,000

| Date | Customer Name | Invoice No. | Details | Amount |

| 06-12-2025 | Amit Stores | AS/210 | Goods sold | 50,000 |

🔹 Journal Entry

Amit Stores A/c Dr. 50,000

To Sales A/c 50,000

Narration:

(Being goods sold on credit to Amit Stores)

2️⃣ Difference Between Sales Book & Sales Account

Students often confuse karte hain ye dono terms. Difference samjho 👇

| Basis | Sales Book | Sales Account |

| Nature | Subsidiary Book | Ledger Account |

| Record | Day-to-day credit sales | Total sales |

| Entries | Customer-wise | One summary figure |

| Balance | No balance | Appears in Trial Balance |

| Use | Original entry | Final result |

👉 Sales Book se data jaakar Sales Account me post hota hai

3️⃣ Sales Return (Return Inward)

🔹 Meaning (Hinglish)

Jab customer goods wapas karta hai, use Sales Return kehte hain.

Isse Return Inward bhi bola jaata hai.

👉 Matlab:

“Customer ko maal pasand nahi aaya ya defect tha, isliye usne wapas kar diya.”

🔹 Common Reasons for Sales Return

- Goods damaged during delivery

- Wrong goods supplied

- Quality not as expected

- Late delivery

🔹 Format – Sales Return Book

| Date | Customer Name | Credit Note No. | Details | Amount (₹) |

🔹 Practical Illustration (December 2025)

12 December 2025 ko Amit Stores ne ₹8,000 ke goods return kiye

| Date | Customer Name | Credit Note No. | Details | Amount |

| 12-12-2025 | Amit Stores | CN/18 | Goods returned | 8,000 |

🔹 Journal Entry for Sales Return

Sales Return A/c Dr. 8,000

To Amit Stores A/c 8,000

Narration:

(Being goods returned by Amit Stores)

4️⃣ Credit Note – Concept Made Easy

🔹 What is a Credit Note? (Hinglish)

Credit Note ek document hai jo seller customer ko issue karta hai, jab:

✔ Customer goods return kare

✔ Seller ne extra charge kar diya ho

✔ Discount baad me allow kiya jaye

Simple language me:

“Customer ka bill kam karne ka official proof = Credit Note”

🔹 Who Issues Credit Note?

- Seller issues Credit Note

- Buyer issues Debit Note (opposite case)

🔹 Format – Credit Note

Credit Note No: CN/18

Date: 12-12-2025

| Particulars | Amount (₹) |

| Goods returned | 8,000 |

🔹 Accounting Effect of Credit Note

- Customer ka account credit hota hai

- Sales Return account debit hota hai

- Amount receivable kam ho jaata hai

🔁 Complete Accounting Flow (December 2025)

- Credit sale recorded in Sales Book

- Posting done to Sales Account

- Goods returned recorded in Sales Return Book

- Credit Note issued to customer

- Journal entry passed with narration

👉 Yehi real-life business accounting flow hai.

🧠 Exam & Revision Quick Points

- Sales Book records credit sales of goods only

- Sales Account shows total sales

- Sales Return = goods returned by customer

- Credit Note = issued by seller

🎯 Conclusion

Sales Book, Sales Return aur Credit Note accounting ke core foundation topics hain.

Agar ye clear ho gaye, to journals, GST, debtors management aur final accounts sab easy lagne lagenge.

Ye blog specially banaya gaya hai Class 11 students aur beginners ke liye — simple, practical aur exam-oriented.