Day 2 – Understanding ‘Tax Year’ under Income Tax Act, 2025

How the New Law Replaces Previous Year & Assessment Year to Remove Confusion

Introduction: Why Day 2 Matters

One of the most fundamental and structural changes introduced by the Income-tax Act, 2025 is the replacement of the concepts of “Previous Year” and “Assessment Year” with a single concept called “Tax Year”.

For decades, students, taxpayers, and even professionals have struggled with the dual-year framework under the Income-tax Act, 1961. The new Act addresses this long-standing issue head-on.

This blog (Day 2 of the 15-day Income Tax Act, 2025 series) explains:

- What the old system was

- Why it was confusing

- What exactly “Tax Year” means

- Why “Financial Year” still exists

- How conflicts with the old Assessment Year are avoided

1. The Earlier Framework under the Income-tax Act, 1961

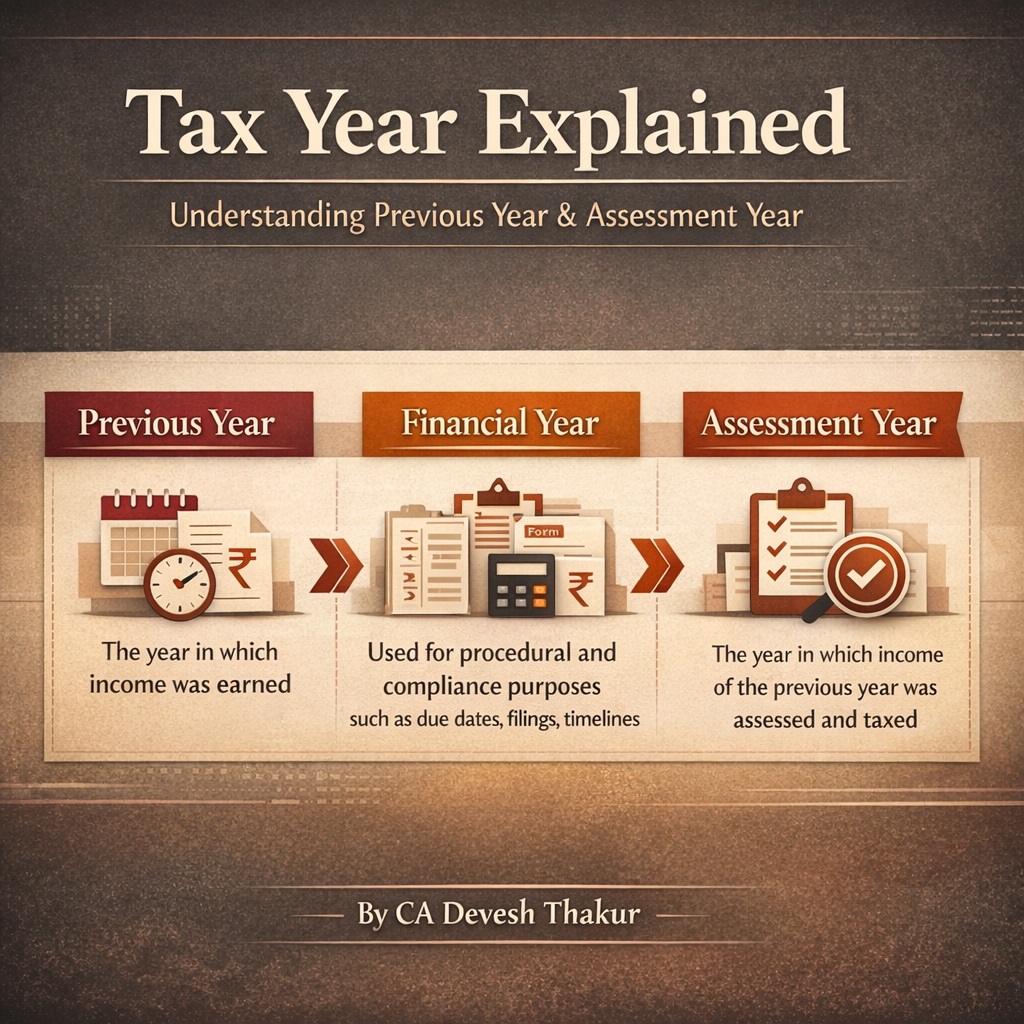

Under the 1961 Act, income taxation revolved around three different concepts:

(a) Previous Year

The year in which income was earned.

(b) Assessment Year

The year in which income of the previous year was assessed and taxed.

(c) Financial Year

Used for procedural and compliance purposes such as due dates, filings, and timelines.

Practical Issue

For the same income, taxpayers had to deal with:

- One year for earning income, and

- Another year for taxation

This duality created avoidable confusion, especially for:

- Students

- First-time taxpayers

- Small businesses

2. Major Reform under Income-tax Act, 2025: Introduction of “Tax Year”

To simplify the structure, the Income-tax Act, 2025 abolishes the concepts of Previous Year and Assessment Year and introduces a single unified concept – “Tax Year.”

What is a Tax Year?

A Tax Year is:

- A 12-month period

- Commencing on 1st April

- Ending on 31st March of the following year

📌 Example:

Tax Year 2026-27

→ 1 April 2026 to 31 March 2027

Under the new law:

- Income is earned in the Tax Year

- Income is taxed with reference to the same Tax Year

- Assessment also relates to the same Tax Year

This ensures one income period = one tax reference year.

3. Legislative Intent Behind the Change

The Select Committee on the Income-tax Bill clearly acknowledged that:

- The dual concepts of previous year and assessment year were a long-standing source of confusion

- Replacing them with a single term “Tax Year” makes the law:

- More accessible

- Easier to comprehend

- Aligned with global tax practices

Although many countries follow a calendar year, India has retained the April–March cycle, ensuring continuity while improving clarity.

4. Role of “Financial Year” under the New Act

An important point to note is that Financial Year has not been abolished.

Why Financial Year Still Exists?

The term Financial Year continues to be used for:

- Compliance timelines

- Procedural provisions

- Filing due dates

- Rectification periods

- Other administrative actions

Key Distinction

| Purpose | Term Used |

| Income computation & taxation | Tax Year |

| Compliance & procedural timelines | Financial Year |

Thus, Tax Year and Financial Year serve different purposes, even though they may coincide in many cases.

5. Why “Tax Year” Was Not Replaced with “Financial Year”

A critical reason for introducing a separate term “Tax Year” is that:

👉 A Tax Year can be shorter than a Financial Year.

Example:

If a business is set up on 1st October, the Tax Year will run from:

- 1 October to 31 March

In such cases:

- Calling this period a “Financial Year” would be incorrect

- Hence, the law needs a distinct concept of “Tax Year”

6. Can a Tax Year Be Less Than 12 Months?

Yes.

A Tax Year may be shorter when:

- A business is newly set up during the year, or

- A new source of income comes into existence

In such cases:

- Tax Year begins from the date of commencement

- Ends on the last day of that financial year

7. Most Important Clarification – FAQ 1.5 Explained in Detail

The Common Doubt

If the new Act comes into effect from 1st April 2026, will:

- Tax Year 2026-27 under the new Act

conflict with - Assessment Year 2026-27 under the old Act?

Answer: No conflict at all

Reason Explained Step-by-Step

- Assessment Year 2026-27 (Old Act)

- Relates to income earned in FY 2025-26

- Governed by the Income-tax Act, 1961

- Tax Year 2026-27 (New Act)

- Relates to income earned in FY 2026-27

- Governed by the Income-tax Act, 2025

Conclusion

Both years:

- Refer to different income periods

- Are governed by different laws

- Do not overlap

Hence, there is no confusion, no duplication, and no conflict.

8. Final One-Line Summary for Students

The concept of “Tax Year” replaces the dual concepts of Previous Year and Assessment Year to create a single, clear, and uniform unit period of taxation under the Income-tax Act, 2025.

What’s Next in the Series?

This blog is Day 2 of the 15-Day Income Tax Act, 2025 Series.

Each day focuses on one core structural or conceptual change in the new law.