The Union Budget 2026–27 marks a decisive shift from short-term optics to long-term structural intent. Anchored in the vision of Viksit Bharat, the Budget prioritises productivity, resilience, and inclusiveness while maintaining fiscal discipline. The Finance Minister’s approach is clear: action over ambivalence, reform over rhetoric, and people over populism .

This Budget is structured around three Kartavya (duties)—accelerating growth, building people’s capacity, and ensuring inclusive development—supported by deep reforms across manufacturing, MSMEs, infrastructure, services, agriculture, and taxation.

Macroeconomic Context and Fiscal Discipline

India enters FY 2026–27 with a strong macro foundation:

- GDP growth sustained at around 7%

- Moderate inflation

- Stable monetary conditions

- Declining debt-to-GDP ratio (55.6%)

- Fiscal deficit reduced to 4.3% of GDP

Public capital expenditure has risen sharply over the decade—from ₹2 lakh crore in FY15 to ₹12.2 lakh crore in FY27, reinforcing infrastructure-led growth without compromising fiscal prudence .

Manufacturing Push: Strategic and Frontier Sectors

The Budget aggressively strengthens domestic manufacturing to reduce import dependence and build global competitiveness. Key initiatives include:

- Biopharma SHAKTI with ₹10,000 crore outlay to position India as a global biologics hub

- India Semiconductor Mission 2.0 focusing on full-stack Indian IP and supply chains

- Expanded Electronics Components Manufacturing Scheme (₹40,000 crore)

- Dedicated Chemical Parks, Rare Earth Corridors, and Container Manufacturing Scheme

- Reviving 200 legacy industrial clusters through infrastructure and technology upgrades

Targeted customs and income tax exemptions—especially for bonded manufacturing zones and aircraft components—further enhance India’s manufacturing ecosystem .

MSMEs: From Survival to “Champion Enterprises”

MSMEs are no longer treated as peripheral players. The Budget introduces a three-pronged support framework:

- Equity Support: ₹10,000 crore SME Growth Fund and ₹2,000 crore top-up to Self-Reliant India Fund

- Liquidity Support: Mandatory use of TReDS, CGTMSE-backed invoice discounting, and asset-backed securitisation of receivables

- Professional Support: Development of Corporate Mitras via ICAI/ICSI/ICMAI to reduce compliance friction

Removal of the ₹10 lakh per-consignment cap on courier exports directly benefits small exporters .

| What is the transaction? | Old TCS Rate | New TCS Rate | What it means in simple words |

|---|---|---|---|

| Sale of alcohol for human consumption | 1% | 2% | Buyer will now pay higher TCS |

| Sale of tendu leaves | 5% | 2% | TCS burden reduced significantly |

| Sale of scrap | 1% | 2% | Slight increase in TCS |

| Sale of coal / lignite / iron ore | 1% | 2% | Higher TCS on mineral sales |

| Foreign remittance for education or medical treatment (above ₹10 lakh) | 5% | 2% | Relief given – lower TCS |

| Foreign remittance for other purposes | 20% | 20% | No change |

| Overseas tour package (any amount) | 5% / 20% | 2% | Major relief for travellers |

The government is trying to reduce friction, cut paperwork, and stop over-penalising honest taxpayers. Most of these changes either lower tax deducted upfront, extend deadlines, or remove criminal fear for small mistakes.

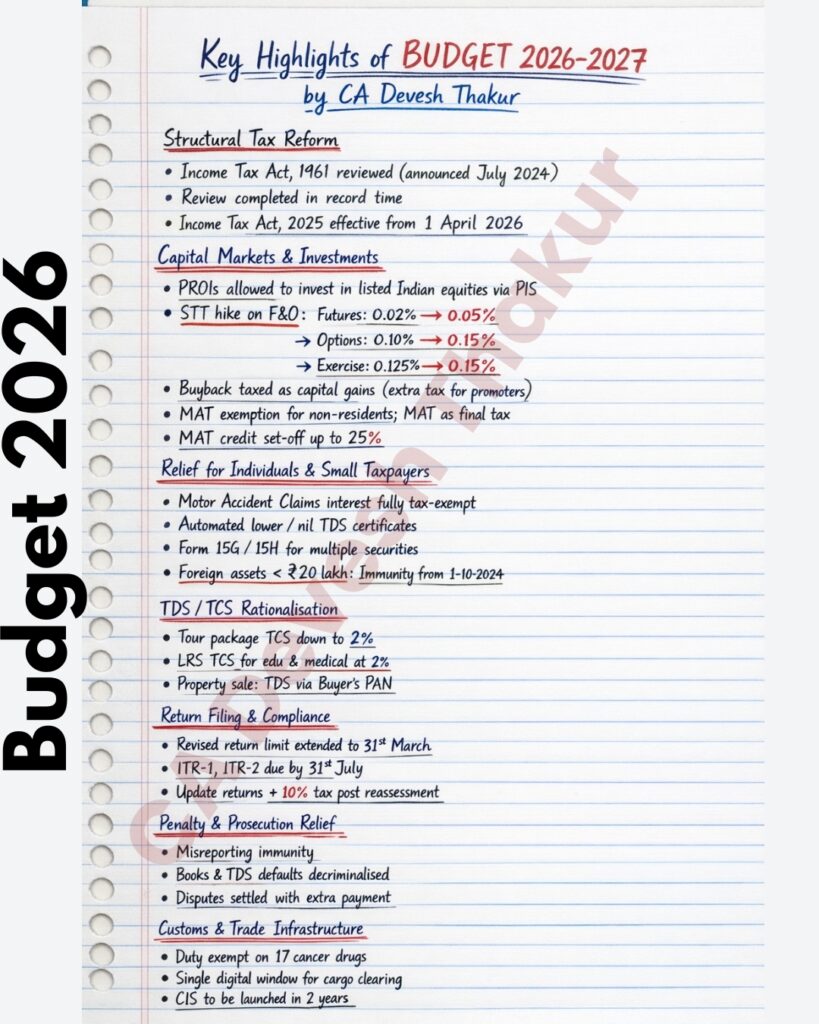

1. For individuals & NRIs

- NRIs living abroad can now easily invest in shares of listed Indian companies.

- Compensation interest from accident cases won’t be taxed anymore.

- If you travel abroad, less tax will be collected upfront on tour packages.

- If you send money abroad for education or medical treatment, lower TCS applies.

- Small foreign assets (below ₹20 lakh) not disclosed earlier won’t land you in jail anymore (retrospective relief).

- One-time chance to declare small foreign assets without harsh consequences.

👉 Translation: Less fear, less tax deduction, more flexibility.

2. Filing Income Tax Returns (ITR) just got easier

- You now have time till 31 March to revise your return (earlier 31 Dec).

- Even after reassessment starts, you can still update your return by paying extra 10% tax.

- ITR-1 & ITR-2 deadlines remain 31 July (no surprise here).

- Small taxpayers can get lower or zero TDS certificates automatically—no begging the department.

👉 Translation: More time, fewer penalties, second chances allowed.

3. TDS / TCS – less money blocked

- Manpower supply services TDS reduced to 1% or 2%.

- Overseas tour TCS slashed to 2% (earlier up to 20%).

- Education & medical remittances TCS reduced to 2%.

- Buyer of property from an NRI can deduct TDS using PAN instead of TAN (simpler).

👉 Translation: Cash flow improves; fewer refunds stuck for months.

4. Criminalisation → De-criminalisation

- Not producing books or delay in TDS payment is no longer a criminal offence.

- Penalty & prosecution immunity extended even to some misreporting cases.

- Honest taxpayers can settle disputes by paying extra amount instead of fighting cases for years.

👉 Translation: Tax law moves from “police mindset” to “compliance mindset”.

5. Corporate & MAT changes

- Non-residents under presumptive taxation won’t pay MAT.

- MAT to become final tax—less confusion.

- MAT credit set-off allowed up to 25% of tax liability in new regime.

- Buyback tax treated as capital gains, but promoters pay extra tax.

👉 Translation: Cleaner tax structure, but promoters don’t escape.

6. Trade, customs & healthcare

- 17 cancer drugs exempt from basic customs duty → cheaper treatment.

- Single digital window for cargo clearance.

- Customs Integrated System coming in 2 years.

👉 Translation: Faster imports, lower costs, better logistics.

📥 Download the Detailed Budget PDFs (Important)

At this point, readers who want original government documents and official explanations should download the source files for deeper reference:

👉 Download the Budget Speech 2026–27

👉 Download Key Features of Budget 2026–27

👉 Download Key to Budget Documents 2026–27

Services Sector: The New Growth Engine

Recognising the employment potential of services, the Budget introduces:

- A High-Powered Education-to-Employment Committee

- Medical Value Tourism hubs in partnership with states

- Expansion of AYUSH, allied health professionals, and caregiver training (1.5 lakh caregivers)

- AVGC Content Creator Labs in 15,000 schools and 500 colleges

- A new National Institute of Design (Eastern India)

Tax reforms provide safe harbour certainty for IT services, higher thresholds, faster APA resolution, and long-term tax holidays for cloud and data centre services .

Infrastructure, Urbanisation & Energy Security

Infrastructure remains the backbone of growth:

- Infrastructure Risk Guarantee Fund for private investment confidence

- New Dedicated Freight Corridors and 20 National Waterways

- Coastal Cargo Promotion Scheme to double modal share by 2047

- High-Speed Rail corridors connecting major city clusters

- ₹20,000 crore outlay for Carbon Capture, Utilisation and Storage (CCUS)

Energy security measures include customs duty exemptions for lithium-ion batteries, solar glass inputs, nuclear projects, and critical mineral processing .

Agriculture & People-Centric Development

The Budget focuses on income enhancement, not subsidies:

- Integrated fisheries development (500 reservoirs, coastal value chains)

- Dedicated programmes for coconut, cashew, cocoa, sandalwood, and horticulture

- Bharat-VISTAAR, an AI-powered agri advisory system

- SHE-Marts to scale women-led rural enterprises

- Divyangjan-focused skilling, assistive devices, and livelihood programmes

These initiatives align economic growth with social empowerment .

Direct Tax Reforms: Ease, Not Optics

A major milestone is the Income Tax Act, 2025, effective 1 April 2026:

- Simplified forms and rules

- Extended timelines for revised returns

- Lower TCS rates under LRS

- Decriminalisation of minor offences

- Rationalised penalties and prosecution

- One-time foreign asset disclosure window for small taxpayers

This is not cosmetic reform—it directly reduces litigation and compliance burden .

Understanding the Budget Documents

The Key to Budget Documents clarifies how to read the Union Budget—AFS, Finance Bill, Demands for Grants, FRBM statements, and explanatory documents—ensuring transparency and accountability in public finance .

Conclusion: A Budget with Direction

Union Budget 2026–27 is not about giveaways or headlines. It is about capacity building, structural reform, and long-term competitiveness. For professionals, entrepreneurs, MSMEs, and investors, the message is clear: adapt, scale, and participate—this policy framework is built for those willing to move.