-

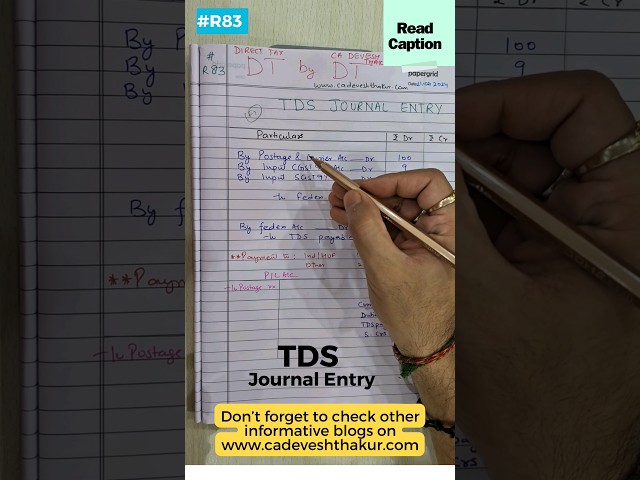

📌How to pass TDS Journal Entry in Books of Accounts/TDS entry with GST in Tally #shorts #shortsfeed

-

📌First Time TDS Return filers? How to file First TDS Return #shorts #shortsfeed #short #shortvideo

-

TDS on Sale of Property| Section 194IA | Buyer Must Deduct 1% TDS on Property ₹50L+ #shorts #viral

-

TDS on Rent of Property| How to File Form 26QC Online | TDS on Rent 194IB| @cadeveshthakur

-

How to download TDS Certificates from TRACES| Form16C|TDS on Rent|Form 26QC|@cadeveshthakur

-

New TDS Rules For Rent 194IB| How To Calculate Tds On Rental Income| @cadeveshthakur

-

TDS RETURN Due Dates: Quarterly & Form 26QB/26QC/26QD/26QE Deadlines #shorts #incometax

-

TDS ki कक्षा | What is TDS? Why, When, and Who is Involved in TDS Deduction?|Part 1|CA Devesh Thakur

-

TDS Forms Explained | Form 24Q, 26Q, 26QB, 16, 26AS & More | TDS Certificates & Due Dates|Part 2

-

TDS ki कक्षा| Interest under TDS, late fees under tds, Penalty under TDS,Prosecution under TDS Part3

-

📌What is TDS? All about Tax Deducted at Source (TDS) #shorts #short #viral #shortvideo #viral #yt

-

New Rule for Calculation of TDS on Salary|Budget 2024|Higher Salary in hand from 1.10.24|TCS Credit